Last Friday, JPM's Nick Panigirtzoglou asked a question: just how illiquid is the Treasury market - still viewed by many as deepest, most liquid market on the planet - and whether the recent rollercoaster in bond yields was first and foremost a function of growing Treasury lack of liquidity (spoiler alert: a lot).

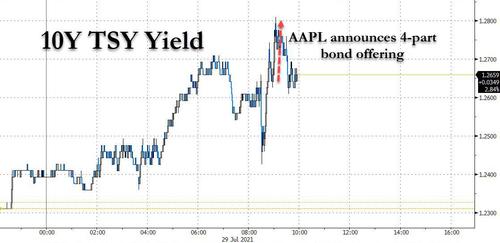

Fast forward to today when we got the latest stark example of this illiquidity, when in the unofficial launch to buyback season, shortly after the disappointing GDP report which sent yields sliding, Apple announced a four-part, back-end loaded debt issuance offering of paper due 2028, 2031, 2051, and 2061 which clearly took the bond market by surprise today, with the result a sharp re-steepening of the Treasury curve and 10Y yield spiking by 2bps to session highs.

Bloomberg confirms that this move was largely rate-locks (i.e., buyers hedging rate exposure) with payers at the back-end of the curve in the U.S. swaps market in London linked to the slog of corporate issuance.

How big is the offering? Therein lies the rub: according to Bloomberg's Alyce Anders, market chatter is that the Apple deal could be in the $6 billion to $8 billion range. In other words, as little as $8 billion in offsetting TSY hedging (i.e., shorting) can move the most liquid benchmark paper by 2bps. This is a striking collapse in liquidity in a market that clearly can barely absorb any volume without moving the entire market!

Some statistics: the last time Apple issued a benchmark deal was Feb. 1, 2021 with a $14 billion six-part offering, the technology behemoth’s largest bond offering since it brought $17 billion in 2013. The February order book peaked at $33.7 billion,...