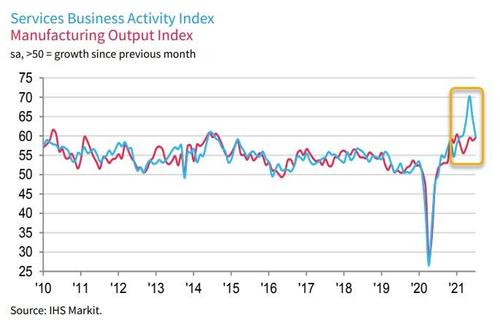

After a mixed bag on the Manufacturing side, (ISM at 2021 lows; PMI at record high), the Services sector did the same... but mirrored.

Markit's Services sector survey slipped to its weakest since February (down from 64.6 to 59.9 in the final July print)

ISM's Services sector roared back from weakness in June to a record high (up from 60.1 to 64.1)

Source: Bloomberg

This mixed message ignores the continuing trend in weaker than expected macro data for the US...

Source: Bloomberg

As the 'hope' in Services tumbles back to reality...

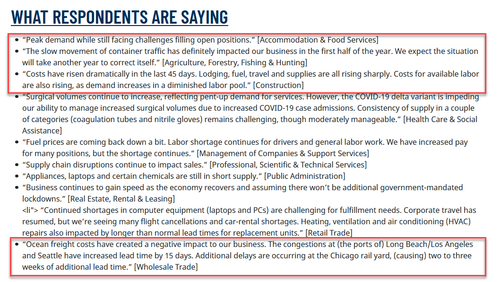

Inflationary pressures remained substantial at the start of the third quarter. Input costs rose markedly, and at one of the fastest rates on record amid significant supplier delays and material shortages.

Source: Bloomberg

Private sector firms noted further efforts to pass on higher costs, where possible, to their clients. As a result, output charges rose at the third-steepest pace since data collection began in October 2009.

Commenting on the latest survey results, Chris Williamson, Chief Business Economist at IHS Markit, said:

“The pace of US economic growth cooled in July, according to the final PMI data, but remained impressively strong to suggest that GDP will rise robustly again in the third quarter. Stimulus measures combined with the vaccine roll out and reopening of the economy continued to boost demand for goods and services, most notably among households and especially in consumer-facing services such as travel and hospitality.

“Some further easing in the rate of expansion is likely in coming months, however, as future growth expectations mellowed considerably during the month....