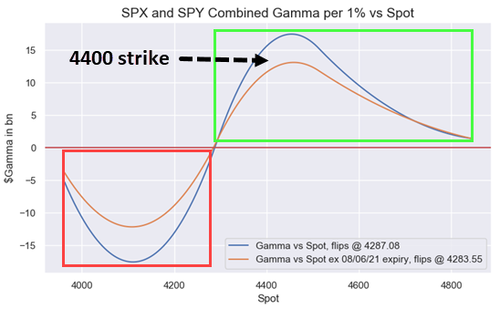

Earlier today we discussed the "incredible anchor" that has emerged around the 4,400 level in spoos and as more traders inquire what is behind this strange attractor, Nomura's Charlie McElligott has followed up on this writing that the 4,400 strike continues to choke markets and dealers on “long gamma” at the money with $7.1B accumulated there (although in a sign that market will likely keep grinding higher, 4450 $5.7BN has been built up at 4,450 and another $4.6BN at 4500 and growing)...

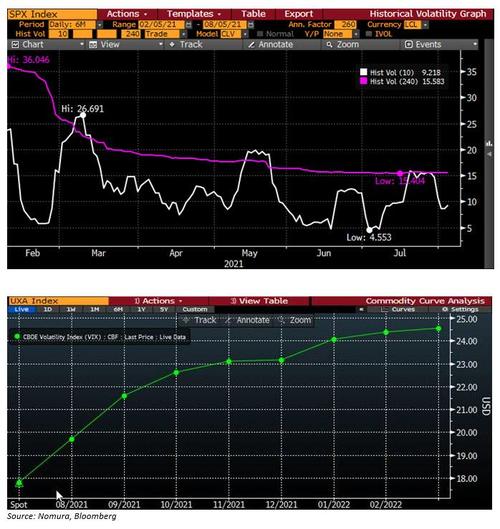

... and as McElligott notes, "we simply cannot break the tractor-beam, as the “strangle seller” laughs his way to the bank…for now"... but in an ominous observations, the Nomura strategist notes that the US equity vol complex remains to “incoherent” or even “broken,” as SPX realized remains cratered (10 day @ 9.2), versus implied vols staying really firm / effectively the entire VIX futs strip ref mid- / low- 20s.

What's behind this dislocation? Well, as McElligott notes, "vol supply/demand dynamics are completely out of wack, which is on account of a number of inputs:...

- Dealers’ regulatory risk management realities, where stress slides show ever-increasing clusters of “rolling VaR events” over almost any lookback period—so you need to somehow be “crash positive” in a -3% / -5% move…but to do your job and facilitate client order flow, the only options you can really run meaningfully “short” is in near-dated expirations without having to pay through the nose away at horribly unecomical levels with another dealer and market maker.

- In-turn, this causes further “daisy-chain” of crash demand and drives the outrageous skew and put skew extremes discussed previously to even more extreme levels (and at risk of “self fulfilling”), all of