Authored by Lance Roberts via RealInvestmentAdvice.com,

Was the second quarter the peak of economic growth and earnings? If estimates are correct and the year-over-year “base effect” fades, such suggests risk to current earnings estimates.

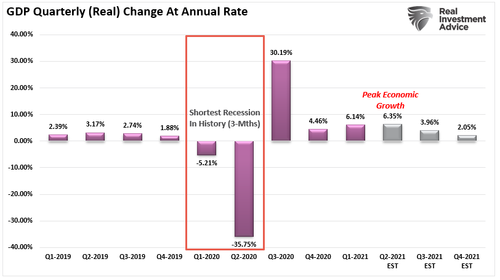

The chart from a “Grossly Defective Product,” utilizes the Atlanta Fed’s current estimates for Q2-2021 GDP. The full-year estimates are from JP Morgan. Notably, the economy quickly slows to 2% heading into 2022.

Estimates of growth are misleading for two reasons.

-

As shown above, growth gets reported as an “annualized” rate. The 6.4% growth in Q2 assumes the 1.6% actual growth will repeat over the next 3-quarters. (1.6% x 4-quarters = 6.4%) Historically, such a feat never occurs.

-

Secondly, the surge in Q2 growth is a function of the contraction in Q2-2020. As such, the growth rate gets exacerbated. (This is the “base effect.”) That growth rate will fall sharply in Q3 as the base effect reverses.

Such was a point made by Goldman Sacks recently, as noted by Zerohedge:

“Goldman cut its 2021 second half consumption growth forecast, resulting in 1% downgrade to its GDP growth forecasts for Q3 and Q4 to +8.5% and +5.0%, respectively. Such is because it is becoming apparent the service sector recovery in the US is unlikely to be as robust as the bank had expected. That is odd considering the trillions in monetary and fiscal stimulus that have entered into the economy.

But while Goldman’s expected 2021 slowdown is manageable, it gets far worse in 2022, when the sluggishness is expected to truly hammer the growth rate, which Goldman now expected to shrink to a trend-like 1.5% – 2%...