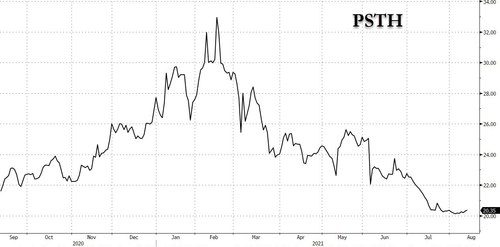

High profile fund manager Bill Ackman wound up torching retail investors when his special-purpose acquisition company, Pershing Square Tontine Holdings, failed to find a merger partner after months of bluster from Ackman and blind faith from investors.

The failure of PSTH to get off the ground resulted in large losses for retail investors, like one 35-year-old unmarried Chicago psychiatrist who lost nearly $1 million "investing" in call options on the pre-merger entity, a new profile by Institutional Investor points out.

PSTH had been touted by Ackman to be an "investor friendly" SPAC. Ackman even "tweeted a rap video about SPACs minting money" in February 2021. Ackman even joked about “marrying a unicorn” when talking about his SPAC's launch last July.

“That video literally single-handedly caused the stock to rise 10 percent,” the investor told II. “It was like, okay, this is coming very soon. If you don’t get in now, you’re going to miss it.”

“Just because I have specialized training doesn’t mean I can’t be just as much of a fool as the guy next door,” the investor said. “Whatever money I had, I pretty much was putting it all into buying more of it," he said of his purchases of June 18, 2021 $25 strike call options. The stock traded at $23 at the time, leaving the options to be a total loss.

But reality hit on June 4 when PSTH announced a deal to take a 10% stake in Universal Music Group. It was a small slice of an investment that left money over for other deals. Then, "hell came"...