Via AdventuresInCapitalism.com,

Investing is a game of keeping powder dry and waiting for layups. So many investors miss this lesson. They stay fully invested in middling situations for various reasons - often mental. Who cares if it is at 90% of fair value?? Recycle your capital. Why are you in a business with deteriorating numbers?? Recycle your capital. So what if it’s cheap, there’s no catalyst?? Recycle your capital. Maybe your capital isn’t precious to you—mine is quite precious to me.

As I’ve matured as an investor, I’ve become less patient with capital that’s earning low returns. This is because I know there’s always another, better story, just waiting to break out onto the scene. I know all too well that there’s an opportunity cost to missing that story. More importantly, experience also tells me that the far bigger and often unspoken cost, is the frictional cost of blasting out of something mediocre at the wrong time to urgently free up capital for that better opportunity.

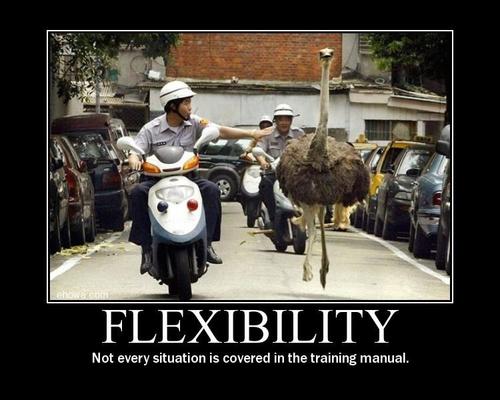

I like to cycle through my positions and recognize when an idea or theme has matured and needs harvesting. No need to squeeze the last bit of toothpaste out—the middle of the move is good enough for me. More importantly, I recognize when an idea is mediocre and when it’s better to just sit in cash, even if it means that I won’t produce much in the way of performance for a few months, or even a few quarters. The value of instant flexibility is just too valuable.

Over the last few days of August, I pivoted from negligible uranium exposure to a position maximum. Having swung large exposures around for two decades, I’m certainly used to rapidly pivoting....