30Y Gilts Soar Most Since Covid Crisis In Giant Short Squeeze After UK Slashes Debt Issuance

While it is of secondary importance to US readers, in the UK everyone was glued to the telly following today's Autumn Budget and Spending Review, and the budget speech in Parliament by Chancellor of the Exchequer Rishi Sunak. For the benefit of our British readers, and for gilt traders everywhere, here is a snapshot of what was just announced courtesy of Bloomberg:

- Sunak presented his third budget, pledging a “new age of optimism” even as the risk of inflation lurks:

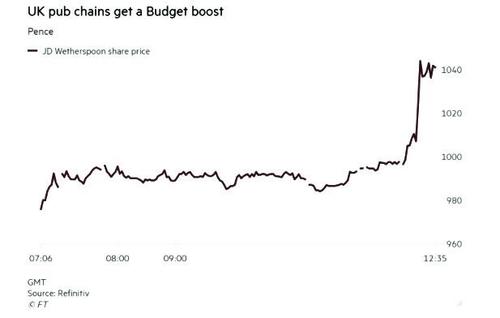

- Sunak cut taxes on alcohol, part of his “radical” plans to simplify alcohol duty, aligning higher rates with stronger drinks, causing pub stocks to rally, and froze a planned rise in fuel duty. He also gave a one-year 50% reduction in business rates to the retail, leisure and hospitality sectors

- With the cost of living rising for Britons, Sunak reformed Universal Credit, increasing how much welfare people will keep as their incomes rise. Specifically, the taper rate on universal credit will be reduced by 8% — from 63 to 55%, a much higher level than expected.

- With upgraded forecasts to economic growth and tax revenues, Sunak committed to real-term increases in departmental spending in all areas of government. As the FT notes, "there’s a lot of spending in this Budget but quite a bit