The four-week-old strike at twelve of Deere & Co.'s Midwest factories and facilities is creating a shortage of new tractors and parts that have forced some farmers to turn to secondary markets.

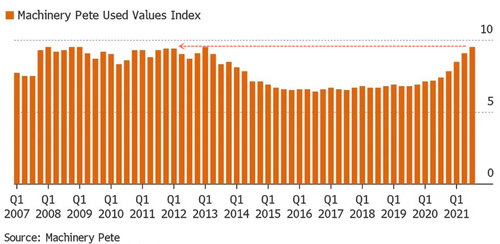

The Machinery Pete Used Values Index, an index of used farm equipment values in North America, jumped to 9.5 in the third quarter, hitting levels not seen since the commodity boom a decade ago. For the first nine months of the year, the index was up 22% and is set to make the largest quarterly gain in the fourth.

Greg Peterson, who has been compiling the index for nearly three decades, told Bloomberg that a match "is now lit while there's a John Deere strike." What he's referring to is that farmers have no other choice than to search for used tractors, equipment, and parts at auction houses because the strike at Deere is inhibiting their ability to source new parts or tractors.

For some context, Machinery Pete's index is equivalent to Kelley Blue Book for cars. It helps farmers assess the value of tractors.

We noted last week farmers would flood the secondary markets amid the Deere strike. Peterson wouldn't give full details about the index's fourth-quarter reading because he has paying clients - but said bidding wars at auctions could push the index to record high levels.

The surge in used prices has gotten to the point now, some farmers say, where it's starting to make them worry they'll struggle to find a tractor if they need one for the planting season next year.

One of the records that Peterson saw fall last week highlighted this angst. There was this John Deere tractor up for sale...