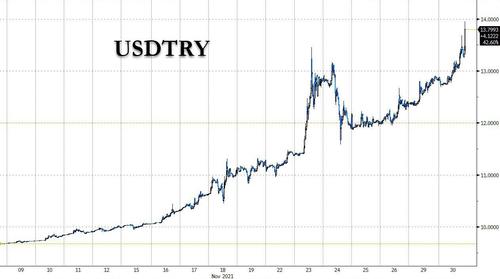

With the lira having lost 40% of its value in just the past 3 weeks (and down almost 50% YTD), now that the market finally realizes just how insane Erdogan has been all along with his intention to keep cutting rates until the mid-2023 Turkish elections...

... and foreign investors pulling their capital from Turkey in a show of defiance to the Erdogan regime - they may return if and when a new, more sensible ruler emerges - overnight the Turkish central bank intervened in the foreign exchange market for the first time in seven years, and in an act of sheer desperation, fought to shore up the plunging lira.

The Turkish Central Bank (TCMB) said in a statement that it took action due to “unhealthy price formations” in the lira, which has been in freefall since President Recep Tayyip Erdogan renewed his push for lower interest rates.

Needless to say, the price formation is "unhealthy" only to the Erdogan regime, the entrenched Turkish state, and Erdogan's puppet central bank, and quite healthy to short sellers who have long been warning that Turkey is doomed to collapse under the Erdogan dictatorship, and only a currency collapse and hyperinflation has any hope of dislodging Turkey's batshit insane ruler.

Indeed, in recent days we have seen sporadic protests against the currency collapse and soaring prices, and Erdogan is scrambling to intercept these before they spread to the rest of the population.

Unfortunately for Erdogan, as Japan, the UK and so many other central banks have demonstrated with their failed intervention attempts, all the TCMB is achieving is blowing through its dollar reserves...