Stocks, Bonds, & The Dollar Dump After Lagarde's Hawkish Comments

ECB President Christine Lagarde has finally been forced to admit reality. Specifically, in this morning's press conference she hawkishly noted that "risk to inflation outlook are tilted to the upside".

Translation - it's not transitory anymore.

She added that the board has "unanimous concern" about inflation data.

Finally, Lagarde noted that the ECB is "getting closer to target" in inflation

That triggered a fresh leg lower in US (and European) stocks...

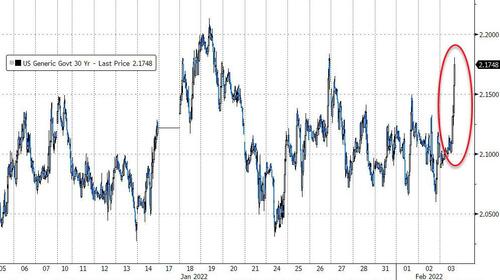

Sent bond yields soaring globally with 30Y UST up 7bps...

And BTPs up 13bps...

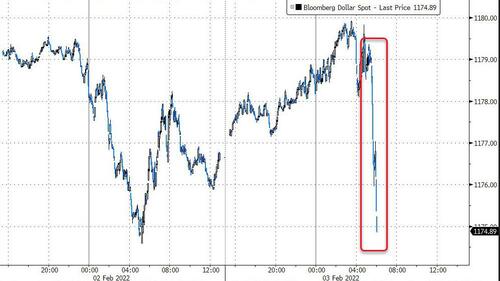

And dumped the dollar as EUR strengthened...

The end result is that EU money markets are now pricing in a 10bps rate-hike by the ECB in June, and a 20bps hike in September....

Tyler Durden Thu, 02/03/2022 - 09:11