Walmart Bucks Surging Costs, Supply Chain Chaos With Strong Results And Outlook, $10 Billion Stock Buyback

Walmart reported Q4 earnings which again topped estimates on Thursday after shoppers turned to the retailer for groceries and gifts over the holidays and said it’s focused on value as some customers grow nervous about inflation. The company also raised its dividend by a cent to 56 cents per share, and unveiled a new buyback of at least $10 billion for fiscal 2023; Looking ahead the largest US bricks and mortar retailer unveiled an upbeat sales outlook for the current fiscal year despite persistent cost pressures and flagging consumer sentiment

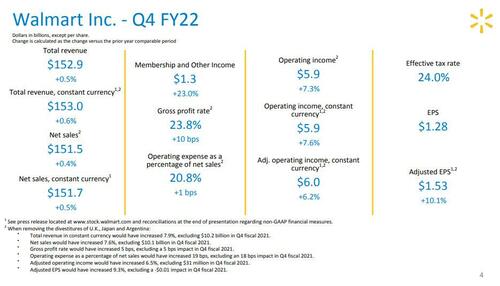

Here is what the company reported for the fourth quarter:

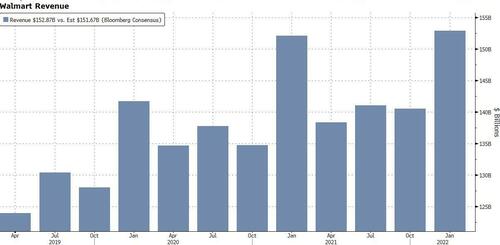

- Revenue $152.87 billion, +0.5% y/y, beating the estimate $151.67 billion

- Adjusted EPS $1.53 vs. $1.39 y/y, beating the estimate $1.51

Some more details:

- Total revenue rose slightly to a record $152.87 billion from $152.08 billion a year earlier, above Wall Street’s expectations of $151.53 billion.

- Walmart posted net income of $3.56 billion, or $1.28 per share, compared with a loss of $2.09 billion, or 74 cents per share, a year earlier. Excluding items, the company earned $1.53 per share. Analysts were expecting Walmart would earn $1.50 per share, according