By Ye Xie, Bloomberg Markets Live reporter and analyst

Foreign investors reduced their holdings of Chinese government bonds by the most ever last month. A few theories could explain the rare outflows, including potential sales by Russia as U.S. and EU sanctions blocked access to most of its foreign reserves. Emerging-market and European funds also could have sold the bonds to meet redemption requests as geopolitical risks escalate.

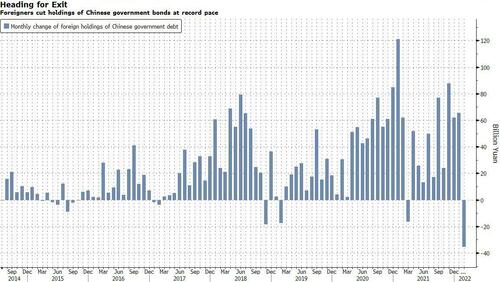

Overseas investors sold a net 35 billion yuan ($5.5 billion) of Chinese government bonds in February, marking the largest monthly cut on record and the first reduction since March 2021, the latest ChinaBond data showed. That marked an abrupt reversal of the recent trend. Inflows averaged 72 billion yuan a month since the end of October, when FTSE Russell added Chinese bonds to its global benchmark.

What’s going on? The first somewhat obvious explanation is that the narrowing yield differential between China and the U.S. dimmed the allure of Chinese bonds. The 10-year yield difference has shrunk to about 105 bps from 250 bps in November 2020. The interest-rate differential has served as a leading indicator for future bond flows. This chart compares the yield difference (six months ahead) and the six-month change in foreign inflows to Chinese bonds.

A second potential explanation is that foreign bond funds, facing redemptions from clients amid the Russia-Ukraine war, have to sell liquid assets to raise cash. With the maximum 10% weighting in JPMorgan’s EM bond benchmark, Chinese debt faces the biggest selling pressure. Indeed, Goldman Sachs lowered its rating on Chinese sovereign bonds from bullish to neutral on Monday, citing redemption risk. “If real money funds continue to face redemptions, and...