We were wondering when we would see a Jerome Kerviel-inspired prop trading blow up as a result of the recent market turmoil, and this morning we got it. According to Bloomberg, Morgan Stanley derivatives trader Hamza El Hassani, is leaving the firm after racking up tens of millions of dollars in losses following the recent burst of market volatility.

El Hassani, who traded dividends in the New York-based bank’s equities division, is leaving the bank after his trading book blew up racking up losses "less than $50 million", Bloomberg reports citing people with knowledge of the matter.

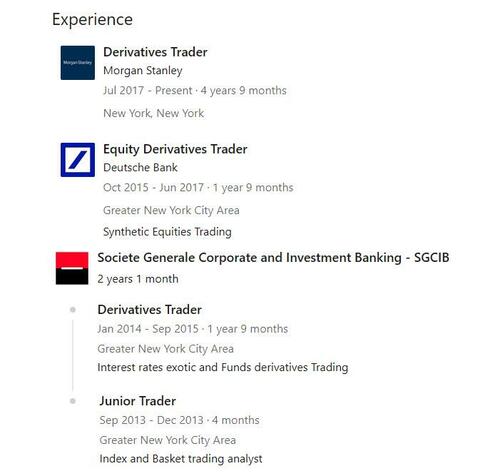

According to his Linked-In profile, El Hassani had been with Morgan Stanely since 2017; previously he worked at Deutsche Bank and with French derivatives-trading powerhouse, Societe Generale, home of such prior spectacular blows up as Jerome Kerviel's infamous January 2008 trade which prompted the Fed to cut rates by 75bps.

It is unclear if El Hassani's trades had anything to do with the recent push by other Wall Street banks, most notably from Goldman Sachs, to get clients into dividend-linked trades.

One thing that is almost certain, however, is that the trader's implosion was linked to the recent record collapse in European Dividend Futures (DEDZ5), whose underlying is the ordinary gross cash dividends announced and paid by the individual constituents, and which suffered a spectacular collapse in the past two weeks following the start of the Ukraine war which left countless dividend paying Russian stocks worthless and crippled countless Russia-exposed European companies. In light of El Hassani's SocGen's background, it is likely that the cause of his loss was a blow up in one or more structured note...