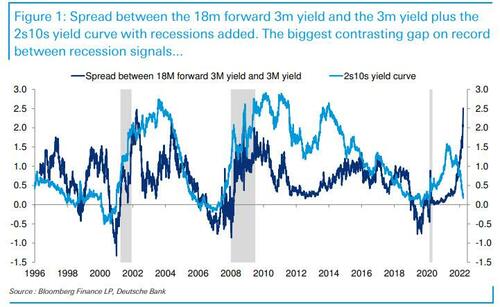

It's not just Wall Street's increasingly less shrill army of legacy permabulls that has dismissed the collapsing 2s10s yield curve in favor of other, less relevant alternatives when it comes to timing the next recession: during Monday's speech by Jerome Powell, the Fed chair did so too, because as DB's Jim Reid explains, the Fed has "long preferred measures like the spread between the 18m forward 3m yield and the 3m yield which as our CoTD shows is now the steepest since on record with data going back to 1996."

This has profound implications, the biggest one being that the Fed won’t see a 2s10s inversion as a reason to slow down rate hikes and that on their measure they have a record level of steepness in their curve to play with before the curve gets to a flat enough level to worry them.

In other words, the Fed won't realize that the US is in a full-blown until as much as 9-12 months after the fact. For his part, Jim Reid writes that "I can’t help but smile when I think that only a year ago the FOMC’s median dot indicated there’d be no rate hikes until at least 2024, and now Fed Funds futures are pricing in nearly 200bps more in 2022... in addition to the 25bps we saw last week.

That said, since the Fed is always wrong about pretty much everything and since Wall Street's permabulls are among the most clueless animals in the world, we certainly agree with Reid that the 2s10s is a far better lead indicator since we can go back with a successful track record over far more cycles than the Fed’s preferred measure...