After Markit's preliminary Manufacturing PMI surprised to the upside, analysts expected ISM Manufacturing in March to rise modestly also... but it didn't...

-

March (Final) Markit US Manufacturing PMI BEAT 58.8 vs 58.5 exp vs 57.3 in Feb

-

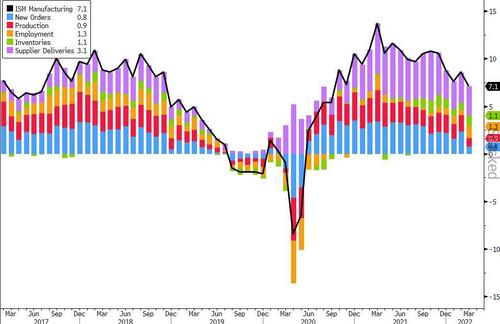

March ISM Manufacturing MISS 57.1 vs 59.0 exp vs 58.6 in Feb

Source: Bloomberg

That is the lowest print for ISM Manufacturing since Sept 2020 with new orders tumbling and prices paid spiking...

Source: Bloomberg

Breaking down the drivers, new orders and production dominate. The group’s index of prices paid by producers jumped 11.5 points, the largest monthly advance since the end of 2020, to 87.1. The outsized increase points to worsening price pressures after Russia’s invasion of Ukraine further drove up the prices of petroleum and metals.

Source: Bloomberg

ISM’s new orders measure slid nearly 8 points in March to 53.8, and the factory output gauge dropped 4 points to 54.5. The indexes -- now both at their lowest levels since May 2020 -- signal some softening in demand amid mounting price pressures and increased uncertainty.

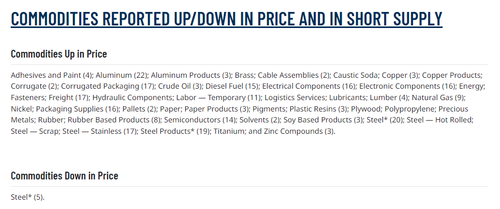

Only Steel is lower in price...

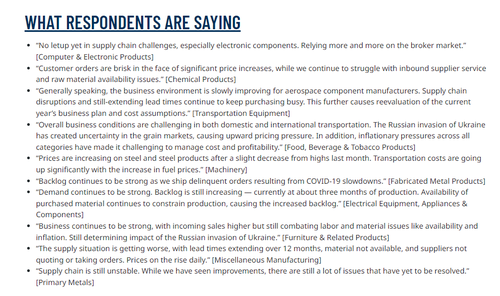

One ISM respondent's comment stood out:

“The supply situation is getting worse, with lead times extending over 12 months, material not available, and suppliers not quoting or taking orders. Prices on the rise daily.”

Chris Williamson, Chief Business Economist at S&P Global, said of the Manufacturing PMI:

“US manufacturing growth accelerated in March as strong demand and improving prospects countered the headwinds of soaring cost pressures...