By Michael Msika, Bloomberg Markets Live reporter and commentator

As equity markets have been in freefall this year, there’s one segment that’s been doing better than most: defensives.

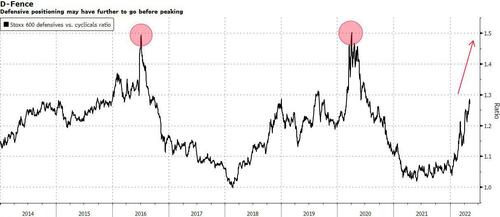

The Stoxx 600 Optimised Defensives Index has fallen just 1.8% in 2022 versus an 18% drop in the equivalent cyclicals index. And with risks around economic growth, interest rates and inflation remaining prevalent, strategists including those at Morgan Stanley and Barclays don’t see that trend changing soon.

“The narrative is turning more defensive, faced with slowing growth and still hawkish central banks,” says Matthew Joyce of Barclays, who sees resilient sectors continuing to perform well.

Comparison with past periods of defensive strength also signals the potential for more to come. Relative gains this year still trail the performance of 2016, brought on by a slowdown in China and Brexit worries, and of 2020 in the early days of the pandemic.

Morgan Stanley strategists led by Graham Secker say that against a “very difficult” macro backdrop it’s “too soon to add cyclical exposure back into portfolios.” They prefer defensives and are overweight pharmaceuticals, telecoms, tobacco and utilities.

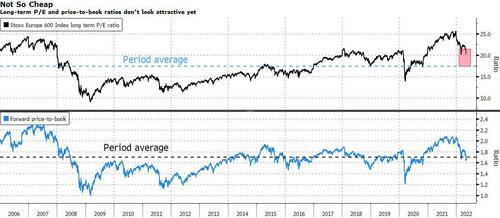

With an earnings downgrade cycle coming, the strategists say equity valuations are “biased” and that stocks remain expensive on a long-term price-to-earnings basis.

By contrast, BNP Paribas strategists led by Ankit Gheedia believe now is the time to buy European stocks, with a 15% drop in earnings already priced in. Fear and sentiment have been driving the market lower and the move is now overdone, they say, recommending banks, energy and the U.K. FTSE 100 Index.

Indeed, some valuation metrics can’t be ignored. Some cyclical and so-called value stocks remain extremely cheap, with autos, miners, energy and banks trading at steep...