By Michael Every of Rabobank

House of Cards

The data that got some heads, and markets, turning yesterday was US new home sales, which slumped 16.6% m-o-m and 26.9% y-o-y to a seasonally adjusted annual rate of 591,000 in April, the lowest level since April 2020. Economists had expected a figure of 748,000. Yes, this is always a very choppy series, but the drop was widespread: -5.9% in the Northeast, -15.1% in the Midwest, -19.8% in the South, and -13.8% in the West.

That’s synchronicity which takes me back to a conversation I had with a Russian-American in mid-2006 when working at another bank, who explained why the US housing market was so vast that it was mathematically impossible for all homes to ever do anything --bad!-- at the same time, and so US mortgage-backed securities were the safest of investments. I kept up a rictus grin, as at that time I had been writing for years about a looming US housing crash, the Western replay of Asia’s 1997 crisis, which the traders around me were disinterested in hearing about: they had brought the guy in to explain how to profit from MBS sales.

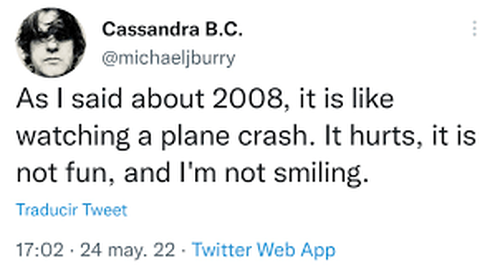

Relatedly, today has seen Michael Burry, of ‘The Big Short’ fame, tweet: ‘As I said about 2008, it is like watching a plane crash. It hurts, it is not fun, and I’m not smiling.’ Once again I agree with him.

Of course, there was no sign of a property slump in the April sales report – quite the opposite. Prices soared yet again, reaching a median of $450,600 vs. $435,000 in the prior...