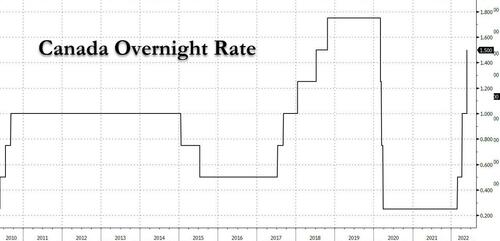

As expected, the Bank of Canada hiked the overnight rate by 50bps to 1.50%, its second consecutive 50bps rate hike in a row, and delivered a hawkish statement that raised worries about inflation pressures intensifying and becoming entrenched at elevated levels; specifically, the Governing Council said it is prepared to act "more forcefully if needed" to meet its commitment to achieving the 2% inflation target.

The back-to-back 50bps increases are unprecedented since the bank began adjusting monetary policy at fixed decision dates in 2000, and are meant to be an overwhelming response to the stronger-than-anticipated inflation dogging the nation.

Policymakers conceded that inflation is rising faster than their April forecasts, and “will likely move even higher in the near term before beginning to ease.”

A redline of the hawkish BOC statement is shown below, courtesy of Newsquawk

While the 50 basis point hike was expected, the language will fuel speculation that policy makers led by Governor Tiff Macklem are considering a faster pace of tightening than they have been suggesting, according to Bloomberg. Currently, markets are pricing in another half-point increase at the July 13 meeting, before slowing the pace of tightening in the second half of this year. The central bank is seen stopping around the 3% mark.

The central bank “is prepared to act more forcefully if needed to meet its commitment to achieve the 2% inflation target,” the Bank said in the statement.

“The risk of elevated inflation becoming entrenched has risen,” the officials said, adding that they will use their tools to return inflation to target and keep expectations “well-anchored.”

As Bloomberg...