By Jeff Diest of The Mises Institute

In fiscal year 2020, at the height of covid stimulus mania, Congress managed to spend nearly twice what the federal government raised in taxes.

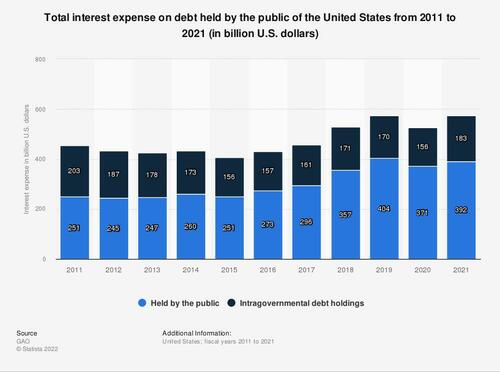

Yet in 2021, with Treasury debt piled sky high and spilling over $30 trillion, Congress was able to service this gargantuan obligation with interest payments of less than $400 billion. The total interest expense of $392 billion for the year represented only about 6 percent of the roughly $6.8 trillion in federal outlays.

How is this possible? In short: very low interest rates. In fact, the average weighted rate across all outstanding Treasury debt in 2021 was well below 2 percent. As the chart below shows, even dramatically rising federal debt in recent years did not much hike Congress's debt service burden.

This is an exceedingly happy arrangement for Congress. Debt is always more popular than taxes for the same reason starting a diet tomorrow is more popular than starting today. Austerity does not sell when it comes to retail politics; spending trillions today while merely adding to what seems like a nebulous, faraway debt definitely does. And American lawmakers are uniquely fortunate in this regard. As French finance minister Valéry Giscard d’Estaing infamously announced in the 1960s, the Bretton Woods monetary system created "America's exorbitant privilege." He understood how the US dollar's status as the world's reserve currency would allow America to effectively export inflation to its hapless trading partners while maintaining cheap imports at home. But he may not have fully grasped the political privilege which would accrue to Congress.

Is this privilege sustainable? That may well be the most important political question of the twenty-first century. As Nick Giambruno explains...