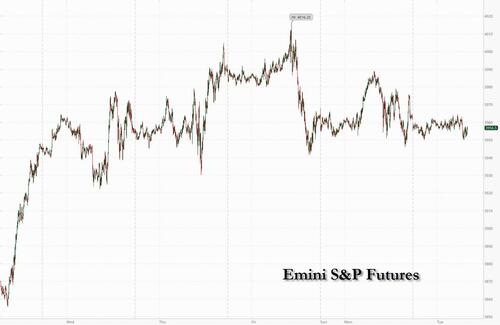

US stock futures dropped as investors braced for Wednesday’s Federal Reserve meeting, while Walmart’s surprise profit warning fueled concerns about the strength of US consumer spending. A barrage of earnings including notable misses by the likes of GM and a 3M guidance cut, did not help the mood. Contracts on the S&P 500 and the Nasdaq 100 were each down 0.4% by 7:45am in New York. European stocks rose driven by energy stocks amid a fresh surge in gas prices following Russia warnings of an imminent halving in NS1 shipments even as European Union countries reached a political agreement to cut their gas use. The dollar jumped and 10Y yields tumbled below 2.75% as a recession looks inevitable, no matter how Biden defines it.

In premarket trading, Alibaba Group jumped 5.1% after the Chinese e-commerce giant said it will seek a primary listing in Hong Kong, boosting other US-listed Chinese stocks with it. Cryptocurrency-exposed stocks were lower as Bitcoin sank to a one-week low, denting hopes for a sustained rebound. Coinbase fell 4% in premarket trading after a Bloomberg News report that the cryptocurrency company is facing a US probe into whether it improperly let Americans trade digital assets that should have been registered as securities. Shares of US big-box retailers and e-commerce peers fell in US premarket trading on Tuesday, after Walmart again cut its quarterly and full-year profit guidance just weeks ahead of its earnings report, raising new questions about the damage from surging inflation to consumers’ spending ability. The shares slid as much as 9.8% in US premarket trading. In premarket trading, Target shares drop as much as 4.9%, Costco Wholesale -2.8%; watch Best Buy shares for later in the session

Online retailers also fall...