Forget inflation, stagflation, recession, depression, earnings, Biden locked up in the basement with covid, and everything else: today's it all about whether Nancy Pelosi will start World War 3 when she lands in Taiwan in 3 hours.

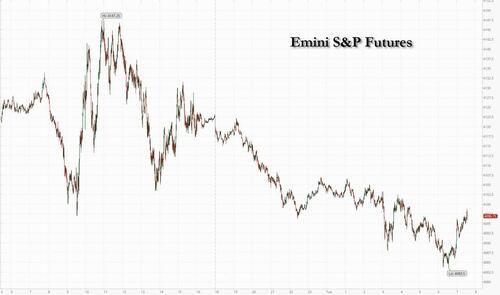

US stocks were set for a second day of declines as investors hunkered down over the imminent (military) response by China to Pelosi's Taiwan planned visit to Taiwan, along with the risks from weakening economic growth amid hawkish central bank policy. Nasdaq 100 contracts were down 0.7% by 7:30a.m. in New York, while S&P 500 futures fell 0.6% having fallen as much as 1% earlier. 10Y yields are down to 2.55% after hitting 2.51% earlier, while both the dollar and gold are higher.

Elsewhere around the world, Europe's Stoxx 600 fell 0.6%, with energy among the few industries bucking the trend after BP hiked its dividend and accelerated share buybacks to the fastest pace yet after profits surged. Asian stocks slid the most in three weeks, with some of the steepest falls in Hong Kong, China and Taiwan.

Among notable movers in premarket trading, Pinterest shares jumped 19% after the social-media company reported second-quarter sales and user figures that beat analysts’ estimates, and activist investor Elliott Investment Management confirmed a major stake in the company. US-listed Chinese stocks were on track to fall for a fourth day, which would mark the group’s longest streak of losses since late-June, amid the rising geopolitical tensions. In premarket trading, bank stocks are lower amid rising tensions between the US and China. S&P 500 futures are also lower, falling as much as 0.9%, while the 10-year Treasury yield falls to 2.56%. Cowen Inc. shares gained as much as 7.5% after Toronto-Dominion Bank agreed to buy the US...