By Jane Foley, head of FX strategy at Rabobank

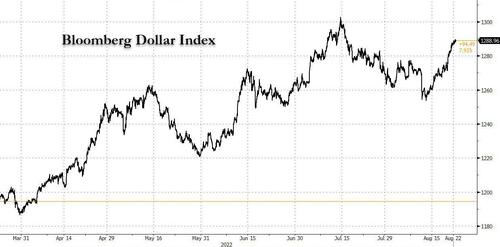

When the July US CPI inflation report posted a softer than expected reading in August 10, the market took that as a signal that US inflation may have peaked and that it may have over-estimated the number of Fed rate hikes that was priced in. This refreshed enthusiasm for US stocks and simultaneously knocked the USD lower. Last week, sentiment reversed. Stock market indices struggled, and the Bloomberg dollar index rose to a 1 month high, having climbed over 2% on the week.

The better tone in the USD was driven by several hawkish comments from Fed officials. This signalled that The Fed’s Jackson Hole Symposium at the end of this week may underpin a similar message.

Another driver of the dollar in recent sessions has been safe haven flow. This was sparked at the beginning of last week by a round of softer than expected Chinese July economic data. By Friday the CNY had slumped to its weakest levels in nearly two years vs. the USD encouraged by an unexpected rate cut by the PBoC for one-year medium-term lending facility loans to some financial institutions. CNY weakness vs. the USD continued this morning on the back of further support from Chinese policymakers. The PBoC has lowered the five-year loan prime rate by 15 bps to 4.30% and its one-year loan rate by 5 bps to 3.65%. This should bring down the cost of mortgages and has supported the shares of several Chinese property developers this morning. That said, falling house prices has impacted demand for loans.

Additionally, the market is cognisant that further lockdowns are possible in China which would undermine the outlook...