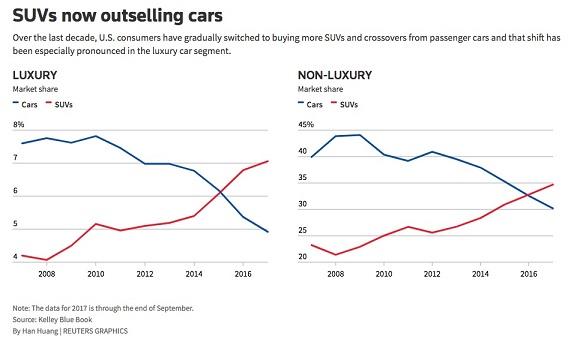

SUVs were, until this month, one of the sole remaining bright spots in the rapidly slowing U.S. auto market. Despite the fact that they were crippling traditional sedan sales, Americans' transition to SUVs was seen as a silver lining, prompting many automakers to make infrastructure changes to account for the change in demand.

Those days, however, seem to be over, according to the latest, February U.S. auto sales data. Fiat Chrysler posted its first monthly sales decline in a year, according to Bloomberg. The kicker? Jeep, the company's driving force for the past several years, showed a rare back-to-back drop in deliveries. Charlie Chesbrough, senior economist of Cox Automotive said: “The results today suggest a much bigger story: The sales pace has finally shifted into a lower gear.”

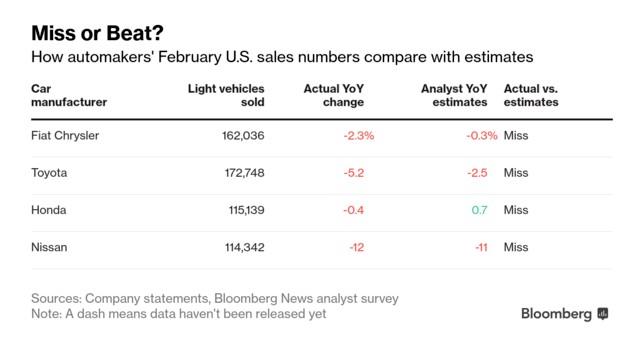

The fact that Jeep sales have slowed is a warning indicator that the SUV "boom" in the U.S. could be coming to an end. Mired by higher interest rates and continued tightening of credit, buyers are forcing once record high SUV sales and prices back down again. As a result, Fiat's Jeep Wrangler sales fell 5.9% in the month, as inventory continued to pile up at dealerships. Fiat joined companies like Toyota, Honda and Nissan, as virtually every OEM both missed analyst estimates for the month and posted an annual sales decline.

Some more details:

- Ford sales, which are now only reported on a quarterly basis, were estimated to have fallen 4.4% in February as a result of the company's F-Series sales falling. The Ford brand's total sales were down 5.1% with Lincoln sales helping cushion some of the blow, rising 15%.

- GM sales are also estimated to have fallen 5.3% in the month, following a 6.9% drop in January.

- Toyota sales were weighed upon by weak demand for its RAV4 compact SUV. Deliveries fell 12.5% for the model as overall sales fell 5.2% in February. Honda saw sales of its Pilot SUV fall 8.8%. Nissan saw deliveries of its Rogue crossover SUV plunge 16%.

In total, the annualized February sales rate slowed to 16.6 million, the worst reading in 18 months, according to researcher Autodata Corp., also missing expectations.

Yet even as SUV sales slump, there does not appear to be a recovery in sight for sedans as demand for the Toyota Camry and Nissan Altima declined by double digits from the year prior. Michelle Krebs, senior analyst for car-shopping researcher Autotrader, told Bloomberg: “Affordability is going to be a challenge for consumers going forward, and we’re beginning to see that.”

As we reported earlier this week, new car prices hit a record high in Q4 2018, with Edmunds reporting that the average transaction price for a new vehicle in December hit an all-time high of $37,260, an increase of $6,598 from December 2010 largely thanks to record high average loan amounts for both new and used cars....