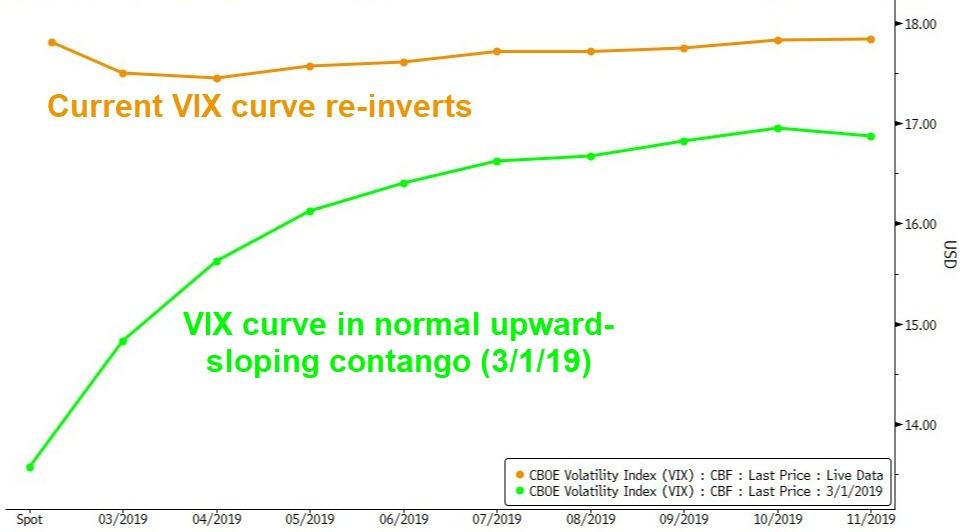

Risk-positioning is violently reversing across systematic strategies, according to Nomura's MD of cross-asset strategy Charlie McElligott, who warns that for the first time in a month, systematic volatility strategies will be forced to pivot back to "long vega" as the VIX curve re-inverts...

Prior “Max Longs” across Global Equities futures being are “at or nearing” de-leveraging / outright pivot SHORT levels as the market sells down through the “mechanically higher” SELL triggers in SPX, NDX, FTSE amongst others

-

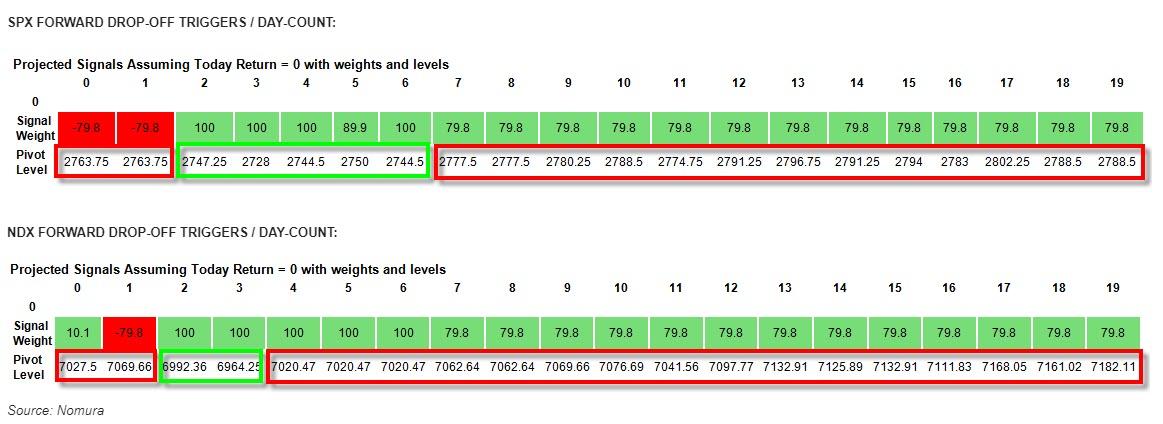

S&P 500, currently 99% long, selling under 2763.25 to get flip to -80% short, more selling under 2728.08 to get to -100% max short (although note that “sell triggers” will temporarily “drop lower” for a few days—see day count 2-6 above--due to the 1Y lookback days, before resuming their move much higher over the course of March through current ‘spot’ in days 7 on out)

-

NASDAQ 100, currently 99% long, selling under 7021.94 to flip to -80% short , more selling under 6992.08 to get to -100% max short

-

Russell 2000, currently -79% short, more selling under 1516.36 to get to -90% , max short under 1516.21, buying over 1585.64 to get to 100% , more buying over 1585.49 to get to 10% , flip to long over 1585.49, max long over 1585.49

-

Euro Stoxx 50, currently 99% long, selling under 3250.55 to get to -80% short , more selling under 3202.36 to get to -100% max short

-

Nikkei 225, currently 99% long, selling under 20826.55 to get to 80%, selling under 20700.39 to get to -100% max short

-

HangSeng CH, currently -79% short, more selling under 10985.05 to get to -90% , max short under 10983.91, buying over 11926.66 to get to 100% , more buying over 11925.52 to get to 10% , flip to long over 11925.52, max long over 11925.52

-

USD_10Y, currently 100% long, selling under to get to 121.95 to get to 60%, more selling under 119.59 to flip and get max short

-

GBP_10Y, currently 100% long, selling under 123.54 to get to 14% , more selling under 121.35 to get to -100% , flip to short under 121.36, max short under 121.35

-

JPY_10Y, currently 60% long, more buying over 152.71 to get to 71% , max long over 152.91, selling under 151.82 to get to 37% , more selling under 150.42 to get to -43% , flip to short under 150.42, max short under 150.42

-

EUR_10Y, currently 100% long, selling under 165.21 to get to 81% , more selling under 164.65 to get to 60% , flip to short under 160.0, max short under 159.99...