Authored by Michael Every via Rabobank,

-

After years in obscurity, MMT is now being discussed --and dismissed-- in high policy circles

-

Many would argue its eventual introduction in some form is inevitable

-

When looked at in detail MMT is not the simplistic argument its critics present it as

-

Some of its fresh, if old, ideas may offer new ways of looking at our present problems

-

However, MMT will also risk creating as many problems as it solves

-

As such, just try saying MMT without saying ‘Mmm’!

Mmm...MT

For those who haven’t noticed, there has been a lot of discussion about Modern Monetary Theory (MMT) in the press of late. The following headlines have appeared in the past few weeks alone:

Alexandria Ocasio-Cortez is a fan of a geeky economic theory called MMT;

Kuroda Foe Says Japan Will Prove MMT a Mistake;

MMT Finds an Embrace in an Unexpected Place Wall Street;

Clearly MMT, which has actually been around for decades, is currently a hot topic at the highest levels. However, even a cursory glance above shows that it is not something there is any agreement over. By contrast, it’s divisive and very controversial.

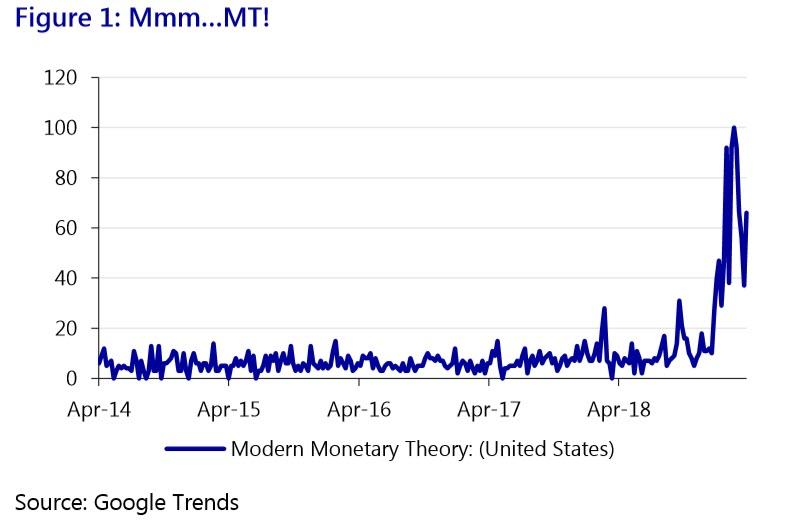

One can also see that public interest in MMT is spiking too. Google Trends interest over time in “Modern Monetary Theory” has shot up since the end of 2018 (see Figure 1) despite it being an obscure, dry, theoretical--and yet controversial-- economic-policy framework.

That is arguably the case in the US because MMT is now politically linked to US Democratic Congresswoman Alexandria Ocasio-Cortez’s “Green New Deal”, with its multi-trillion USD price-tag and radically transformative agenda.

But what is MMT?

We can agree interest in MMT is picking up, and not everyone likes it, but what exactly is it?

The answer is complicated as there is no central MMT textbook. Neither is it an accepted school of thought within market economics, or in orthodox economics departments at universities. As such, most working economists have only a passing familiarity with the name at best, and there is misunderstanding about what MMT does and doesn’t actually encompass.

So let’s start with some basics of what MMT believes before proceeding any further. As we shall see, the premises of MMT are very simple – but the implications for policy and for markets are staggering.

Don’t tax, but spend

Fundamentally. MMT argues the following three things:

-

Sovereign currency-issuing governments, such as the US, are financially unconstrained;

-

...