For once Goldman's Thursday prediction (which itself was a flip-flop from the bank's prior baseline just days earlier) that the US would hike tariffs at midnight, was correct, even if the bank's overly optimistic take on subsequent events, left many disappointed.

Of course, now that higher tariffs are in play, the follow up question is simple: what happens next. To answer that question, as the US-China trade war enters a decisive phase, BofA outlines three scenarios to help clients navigate the economic and market implications. As BofA's Ethan Harris writes, agreeing with Goldman's bullish take, the most favorable outcome is a near-term trade deal, with no additional tariffs. However, the risks have recently risen that the US and China will engage in more brinkmanship. Therefore, in the bank's second scenario there is another round of tit-for-tat tariffs. After a brief period of uncertainty, an agreement is reached. The last and most devastating, if for now unlikely, scenario is a full-blown trade war.

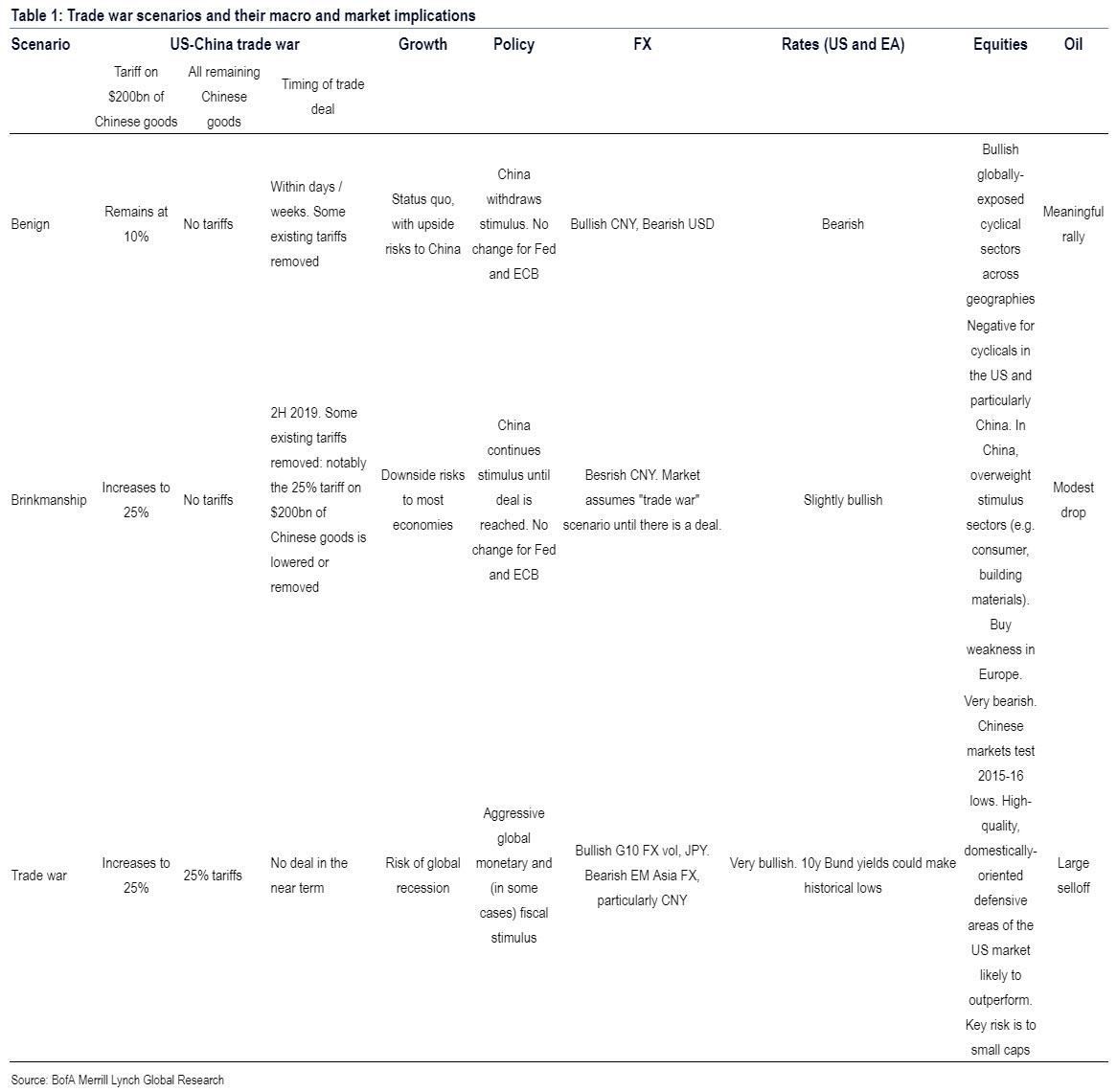

Taking a step back, BofA - like most other banks - sees a very wide range of possibilities, ranging from a quick and market-friendly trade deal to a full-blown trade war. To keep things simple, BofA's chief economist Ethan Harris boils his outlook down into three scenarios that capture the flavor of our view. Table 1 describes these scenarios and their implications for growth, policy and markets. Of course we acknowledge that there are many plausible outcomes even within each scenario.

Here are the details on each possible scenario:

1. Benign outcome

The best-possible outcome is that the US and China are able to reach a trade deal within a few weeks, if not days. In this scenario the US does not follow through on the President's threat to raise tariffs on $200bn of Chinese goods from 10% to 25%. We also assume that some or substantially all of the tariffs that were put in place last year are removed, and that there is no escalation on the auto tariffs front. In this scenario the broad trade "war" becomes narrow trade "skirmishes" and is no longer a major headwind to markets or confidence. Until the President's tariff threat the benign scenario was BofA's baseline, and the reasoning was that the administration would avoid another round of tariffs because it understood the potential negative impact on the markets and the economy. BofA was also of the view that President Trump was eager to get a deal with China ahead of the 2020 Presidential election campaign. Now Harris thinks that it is a very close call, since both countries are on the verge of engaging in at least one more round of brinkmanship.

2. Brinkmanship

A more concerning scenario, which is as likely as the one above, is that the US increases the 10% tariff to 25% as negotiations continue. China would likely retaliate by raising tariffs...