Authored by Ted Dabrowski and John Klingner via WirePoints.com,

Gov. J.B. Pritzker says Illinois’ budget is balanced ”for the first time in decades.” That’s the claim he made upon signing Illinois’ $40 billion budget for 2020. Pritzker’s claim is simply not true. According to the state’s own actuarial calculations, his budget is billions in the red.

A big reason for the unbalanced budget comes from how politicians account for the state’s retirement debts versus how financial professionals do. There’s often a gap of several billion dollars between the two. Hiding that gap has allowed Illinois pols to perpetuate the myth of balanced budgets for decades.

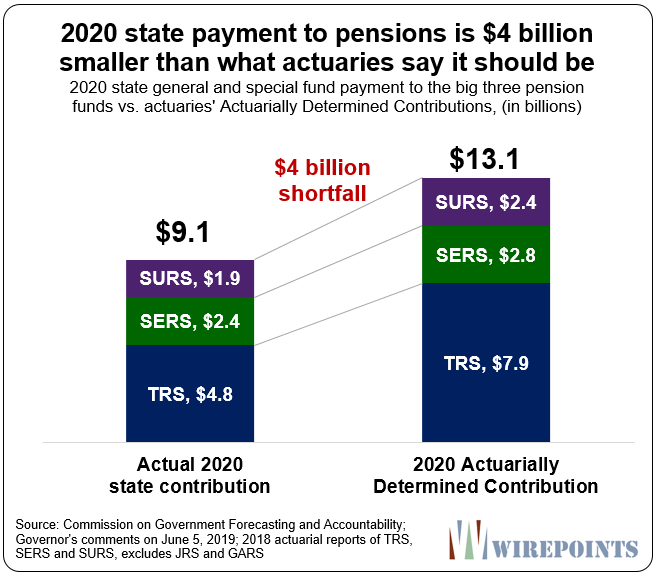

Take Pritzker’s 2020 budget. The state’s pension funding laws, set up nearly 25 years ago by the General Assembly and then-Gov. Jim Edgar, require the state to pay $9 billion* to Illinois’ five state-run pensions in 2020. “We are paying the full payment that is required under the ramp that was put in place in 1995, the statutory required payment,” Pritzker said when he signed the budget.

But what Pritzker ignores is the amount the state’s own actuaries say is required to properly fund Illinois’ pensions in 2020, an amount that exceeds $13 billion. That’s a total shortfall of $4 billion.

And it’s not just pension payments that are being shorted. It’s also payments for state-worker retiree health insurance that are grossly underpaid.

State actuaries calculate the required payments for those benefits at about $4 billion annually, yet the state has only paid around $1 billion yearly in recent years. That’s billions more in shortfalls that Pritzker’s budget ignores.

Defenders of the “balanced-budget” claim will want to paint the above as a matter of semantics. But the billions in shortfalls are not only a matter of accounting. When the state continues to grow its pension promises faster than it can pay for them – and then doesn’t pay enough into its state-worker retirement plans – it doesn’t balance the budget. The state’s debts jump as a result. Illinois’ skyrocketing pension and retiree health insurance debts are the evidence of that.

Illinois not even “treading water”

Despite the fact that Pritzker’s payment to pensions consumes nearly a quarter of the current budget – no other state is in such dire straits – it still won’t stop the state’s pension debts from growing. That’s how sick Illinois’ finances are.

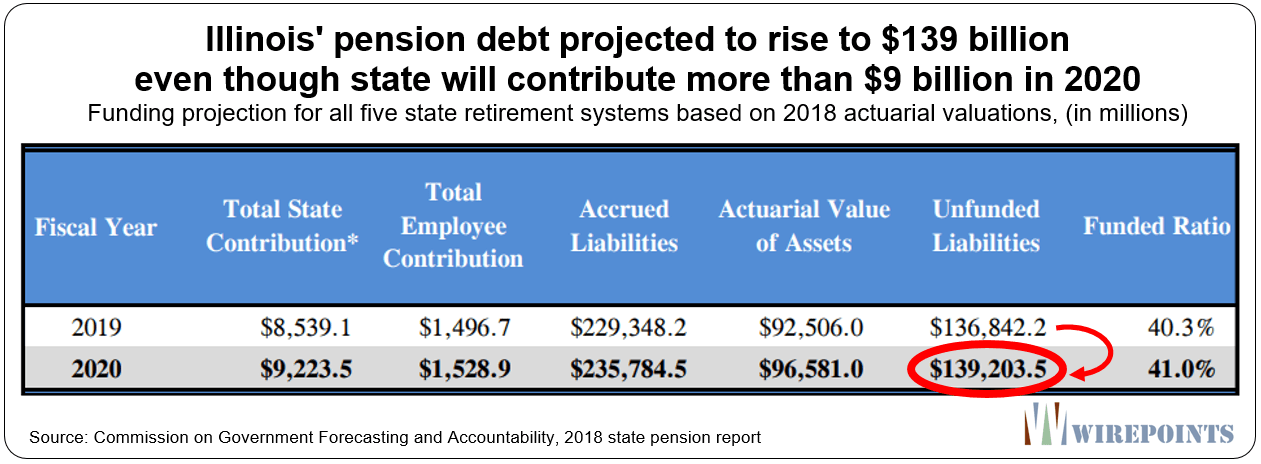

Illinois’ Commission on Government Forecasting and Accountability shows that despite a $9.2 billion* contribution into pensions in 2020, the state’s unfunded liabilities will still increase by $2.4 billion to $139 billion. Illinois is not unlike the financial deadbeat that never pays the minimum payment on his credit card. As a result, its debts just grow.

To just “tread water” – to keep Illinois’ debt flat from one year to the next – the state payment in 2020 should be $2.4 billion higher, or over $11 billion in total....