Authored by Mark Orsley, head of macro strategy at PrismFP

Another undoubtedly firm inflation report as the tariff effect works its way through the pipeline. This means one thing; the stagflation narrative only strengthened today as the US economy slows in the face of supply side inflation.

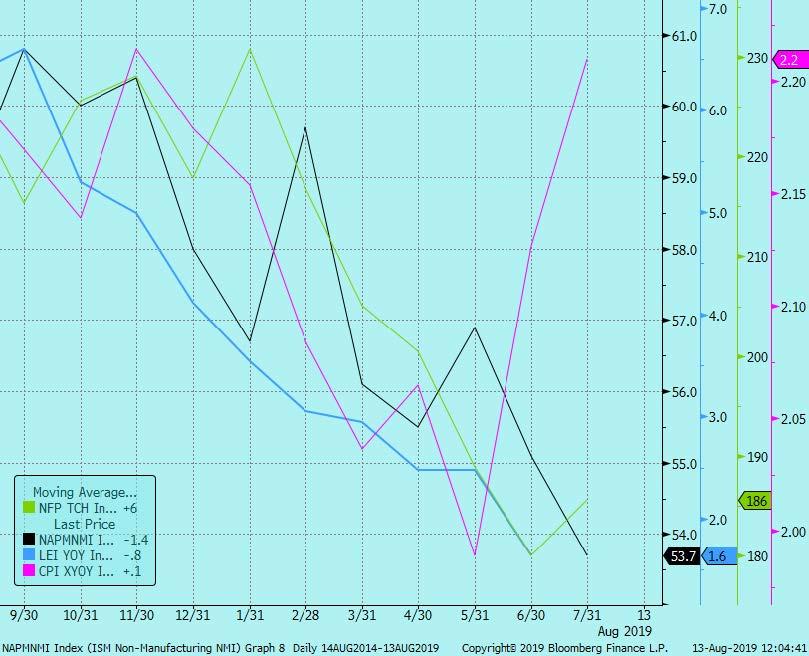

Want to see what stagflation looks like?

-

6m Avg. NFP = green

-

Non-Manufacturing PMI = black

-

Leading Index (YoY) = blue

-

CPI ex-food and energy = pink

In theory this puts the Fed in a quandary. In reality, you should recognize that:

1) The data today implies Core PCE (the Fed’s inflation metric which they derive policy from) at somewhere in the 1.60% to 1.65% range. Firmer than where we were in 2Q, but still below the Fed’s mandate. Therefore, today’s data does not hold the Fed back from easing.

2) The new core of the Fed has a completely new mindset when it comes to inflation where they intend to “make up” for the time core inflation remained below 2% by letting inflation run hot. For example:

-

Williams: “my view is any way that keeps the average inflation rate at 2%”

-

Evans: “ought to communicate comfort with 2.5% core inflation”

-

Brainard: “we make some pre-commitments to making up so that inflation gets to 2% on average over time in a more sustained basis”

So the Fed will not pivot policy by any means with their preferred measure of core inflation not only below their mandate on a one-off basis, but nowhere near their new Average Inflation Targeting mindset.

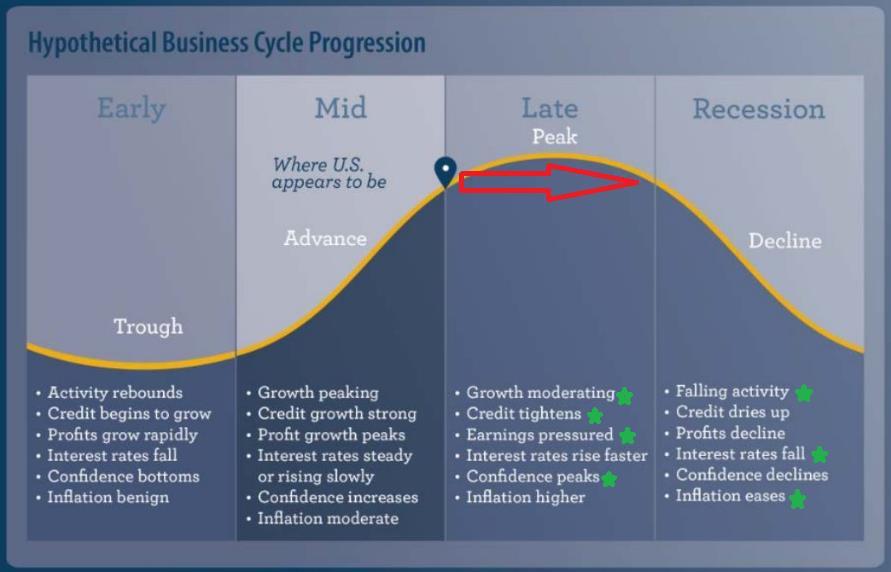

3) At this stage of the cycle (very late with some recession signals), is supply side inflation positive for the economy? It could actually add to the malaise especially with wages now off the highs as seen in AHE, ECI, and even the latest real AHE which is down to 1.3% from a high of 1.9% earlier this year.

In theory, stagflation should be positive for duration (Green Eurodollars are probably the sweet spot) and the steepener. However, Powell delivered the pain for the steepener in the July FOMC press conference when he referred to the July 25bp cut as a “mid-cycle adjustment.” As I stated last week, that is simply intellectually dishonest.

To reproduce the graphic I showed last week in case you missed it, there is absolutely no data point that implies the US economy is mid-cycle. The green stars indicate where those data points are in the cycle. As you can see the US is late, late cycle at risk of entering recession (please see Aug 5th note for supporting charts on each data point).

...