There's no question that, when it comes to analyzing massive droves of data at lightning speeds, computers are far superior to humans. But when it comes to other deeply complicated skills like, say, composing a symphony or penning a critical essay, humans have the upper hand. Why? Because these tasks require higher levels of judgment and reasoning that computers have yet to master.

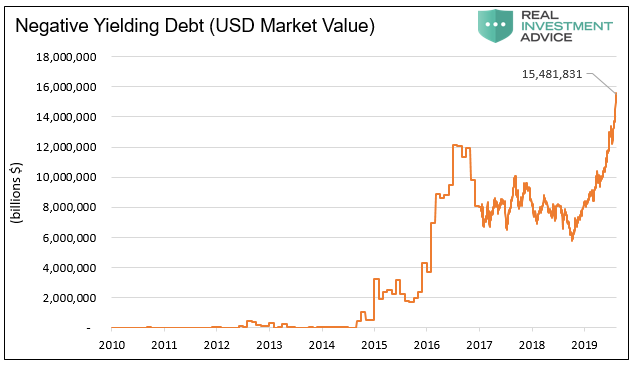

Yet, this could explain why quant funds have performed so well during the epic global bond rally that has dragged yields on $15 trillion in global debt into negative territory this year, virtually eliminating the concept of 'high yield' debt in Europe. Most recently, it sent the yield on the 30-year bund to a record low and allowed Sweden to sell 10-year sovereign debt with an average yield of minus 0.295%, joining an elite group of issuers who have sold debt priced in such a way that buyers who opt to hold it to maturity will face a certain loss.

For humans, particularly for those who lack the luxury of a Phd in economics, it might seem bizarre to ask a lender to pay a borrower for the privilege of borrowing the lender's money. Computers, on the other hand, are totally unfazed by this concept. They're much better at buying when the model says to buy, and selling when it says to sell.

As the FT reports, several quant funds have ridden the epic bond rally to market beating returns while long-short equity peers are still struggling to time the market.

So far this year, managers who held on to their bonds as yields plunged to zero, and below, have reaped some of the biggest profits. We even pointed out that those who bought this 100Y Austrian government bond in the secondary market this week would receive half of their money back in 2117 when the bond matures. Then again, they'd also be dead.

If you buy the Austrian 100Y bond today at 200 cents, at maturity in 2117 you will get half your money back. You will also be dead pic.twitter.com/ynmKhN9WOW

— zerohedge (@zerohedge) August 15, 2019

Which is wy it's so imperative that they find a bigger fool to take the bonds off their hands some time between now and then - and preferably at a higher price.

In the report, the Financial Times, names a few quant funds who have put up huge numbers thanks to their bets on falling yields. ...

Among the biggest winners are computer-driven hedge funds that try to latch on to market trends. While many human traders may question the wisdom of buying or keeping a bond that apparently offers a guaranteed loss, robot traders that monitor price moves have no such qualms.

GAM Systematic’s Cantab Quantitative fund has gained 36.1 per cent,