Authored by Lance Roberts via RealInvestmentAdvice.com,

Willis Towers Watson’s Thinking Ahead Institute (TAI) recently revealed what it considers the 15-extreme risks facing investors for 2019, as well as for the years ahead. The risks run the gamut from climate change to nuclear contamination.

TAI’s research suggests, broadly, there are three hedging strategies available to institutions:

-

Hold cash. Over long historical periods cash has held its real value through both episodes of deflation and inflation but there is no guarantee that this will be the case in the future.

-

Derivatives. It is worth mentioning that cost and usefulness are often in opposition. The cost of derivatives protection can often be reduced by specifying more precise conditions – but the more precise the conditions, the greater the chance that they are not exactly met and hence the ‘insurance’ does not pay out.

-

Hold a negatively-correlated asset. There is no single asset that will work against all possible bad outcomes. Further, there is no guarantee that the expected performance of the hedge asset will actually transpire in the future event.

While we have regularly discussed the“value of holding cash,” and “hedging” within portfolios, for most investors there are only a limited number of options available. The problem becomes magnified by the lack of capital, and a disciplined investment strategy, to delve into and manage more complex risk mitigation strategies. Therefore, investors are simply told to “buy and hold,” and hope for the best.

Since institutions are actively hedging capital risk, it should be clear “buy and hold” strategies do not. However, there are actions you can take to navigate not only short-term market risk, but also long-term fundamental, economic, and environmental risks.

Navigating the Risks

Many of the risks detailed in the TAI report are emotional in nature. For example, climate change is a very long-term issue but has become a political football for the upcoming election. While comments about the “world ending in 12 years” will certainly get headlines, they could also lead individuals into making emotionally based investment decisions that could negatively affect their financial wealth over the longer term.

So, what can you do?

All market cycles ultimately end. What causes those endings are often unexpected events that abruptly disrupt the financial markets.

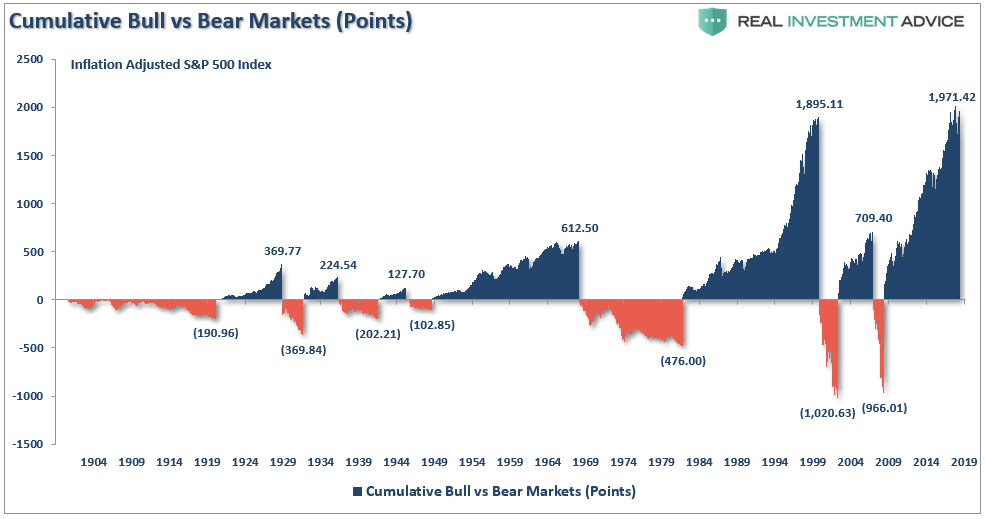

Since the current bull market cycle has returned more than 300% from the financial crisis lows, it is quite likely that by going to cash today an individual would outperform someone who stayed invested in the years ahead. The next “mean-reverting event,” when it occurs, will destroy most if not all of the returns accumulated over the last decade. (That isn’t a theoretical assumption. It’s historical fact.)

It is true you can’t “time the market,” but you can manage risk by adjusting market exposure at times when...