Authored by Lance Roberts via RealInvestmentAdvice.com,

Is the bear market over yet?

This is the question that everyone wants to know. Why? So they can “buy the bottom.”

For that reason alone, I would suggest the current “bear market” is not over yet. Historically speaking, at the bottom of bear market cycles, as we saw in 1932, 1974, 2002, and 2008, there are few individuals willing to put capital at risk.

Given the large number of people on social media clamoring to jump back in the market given the rally this past Friday, it suggests that “optimism,” and “recency bias,” are still far too prevalent in the market.

As noted in this past weekend’s newsletter, Bob Farrell, a legendary investor, is famous for his 10-Investment Rules to follow.

“Rule #8 states:

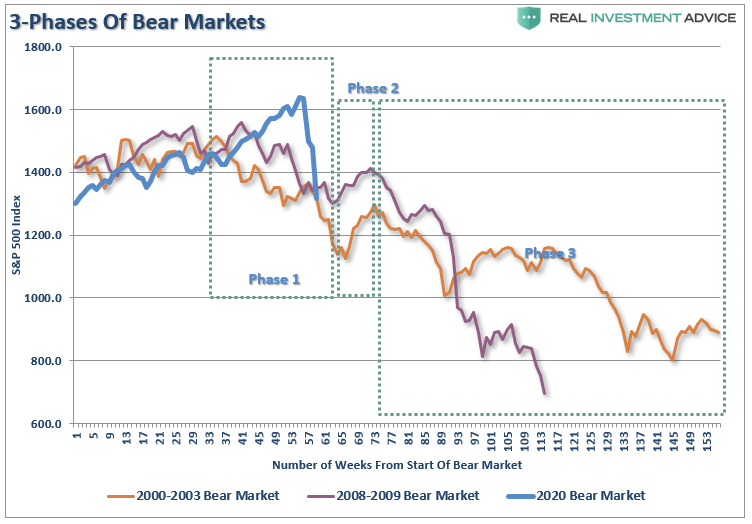

Bear markets have three stages – sharp down, reflexive rebound and a drawn-out fundamental downtrend.”

-

Bear markets often START with a sharp and swift decline.

-

After this decline, there is an oversold bounce that retraces a portion of that decline.

-

The longer-term decline then continues, at a slower and more grinding pace, as the fundamentals deteriorate.

Dow Theory also suggests that bear markets consist of three down legs with reflexive rebounds in between.

While the correction has been sharp in recent weeks, it hasn’t inflicted enough “emotional pain” to deter individuals from jumping back in. As I stated:

“That selloff sets up a ‘reflexive bounce.’ For many individuals, they will ‘feel like’ they are ‘safe.’ This is how ‘bear market rallies’ lure investors back just before...