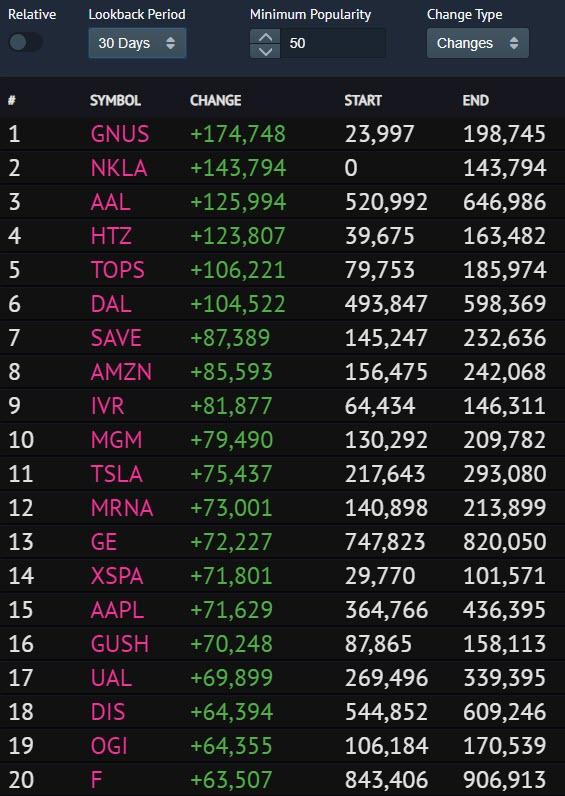

In the latest installment tracking the retail euphoria phase of the bubble now known by everyone as "Jay's Market" (recall that for much of the past decade, the recurring complaints among bulls was that there was zero retail participation so it wasn't really a bull market, well... how about now), Bloomberg profiles not the now infamous Robinhood trading platform which has emerged as the "battleground" for an entire generation of 10-year-old traders, but rather its derivative - the website that tracks the action on Robinhood and which we have frequently used to show recent moves and changes in retail trading momentum: Robintrack.

As Bloomberg reports this morning, RobinTrack - which is not affiliated with the Robinhood investing app, but uses information gleaned from it to show trends in positioning among the brokerage’s users - is a two-year old product of Casey Primozic, "who was wrapping up his undergraduate years at Valparaiso University in Indiana. He was also building a website -- for fun. Little did he know it would grow into a Wall Street obsession."

Now in 2020, his college side project, Robintrack.net, has seen site traffic explode as everyone from day traders to institutions flock there for a picture of what retail investors are buying. Primozic says there’s evidence hedge funds are scraping his data. The 23-year-old programmer can hardly keep up with an overflowing email inbox and is getting barraged with pitches from advertisers.

Why is Robinhood - and by extension Robintrack - so popular among trend watchers? Because "no other brokerage provides this data publicly and directly - making Robinhood users a...