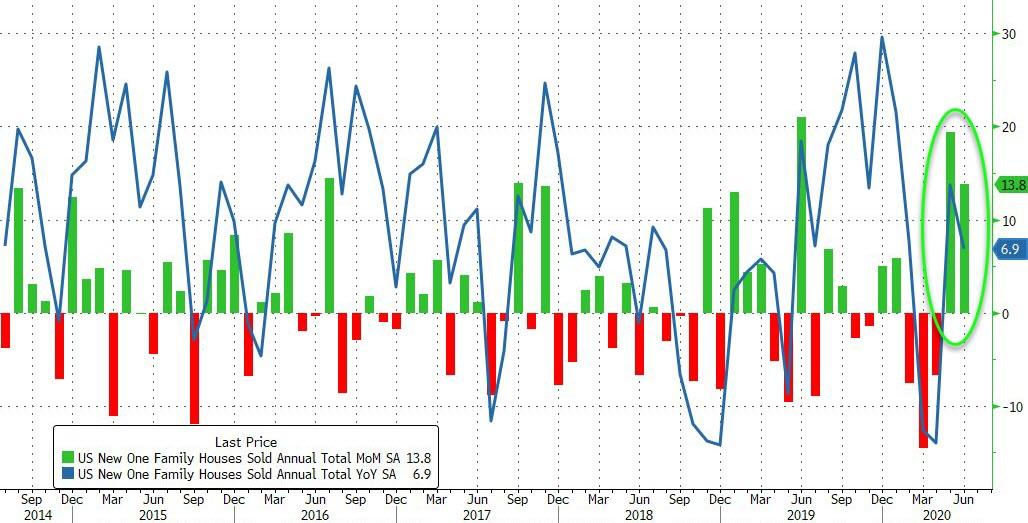

Following existing home sales (admittedly lagging) rebound in June, new home sales were expected to continue their recovery, but at a much slower pace than May's 16.6% surge. However, it massively outperformed, rising 13.8% MoM (vs 3.6% MoM exp) and an upwardly revised 19.4% MoM surge in May (from +16.6%).

This leaves new home sales up 6.9% YoY...

Source: Bloomberg

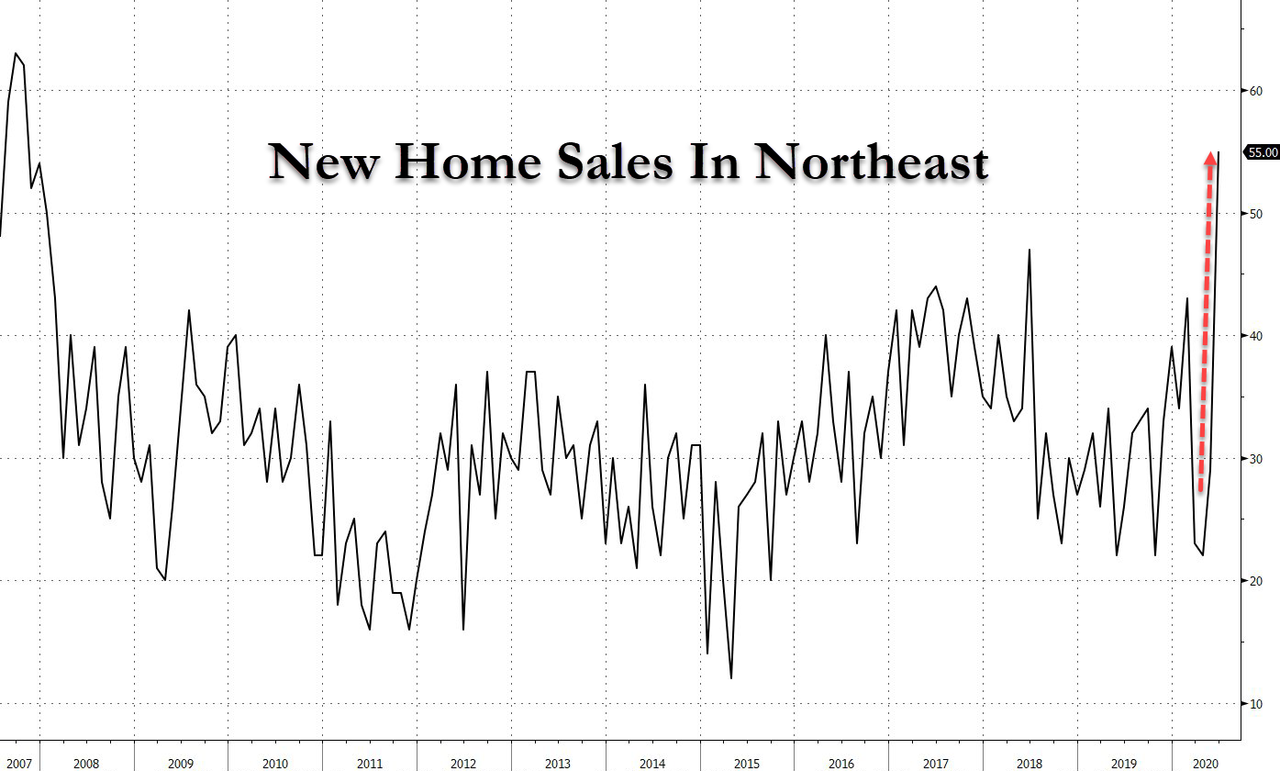

On a year-over-year basis, new homes sold by region is shocking...

-

Northeast: +111.5%

-

Midwest: +33.3%

-

South: -1.8%

-

West: 4.1%

New Home Sales in the Northeast hit 13 year high as exodus from big cities soars on mass protests.

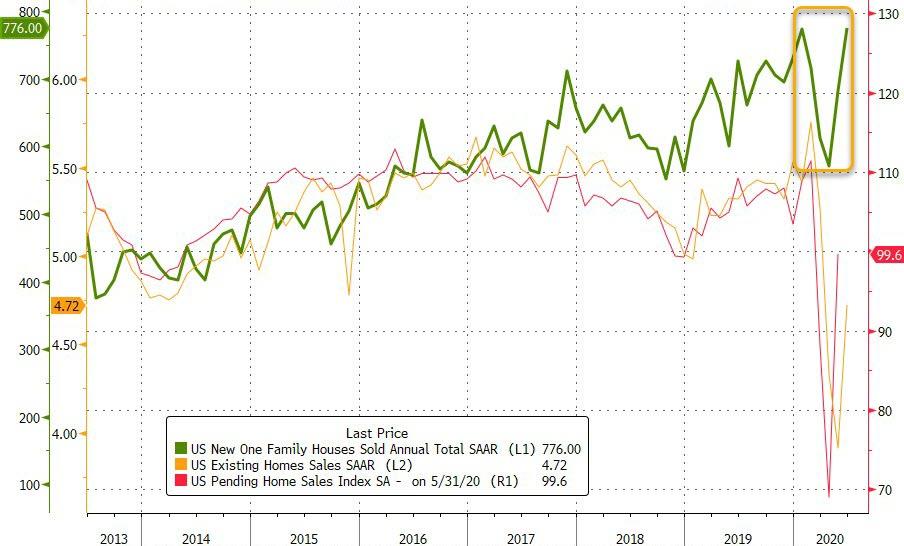

The V-shaped recovery in new home sales is complete...

Source: Bloomberg

The natural question, as we asked previously, is why the housing market was able to bounce so quickly in the face of an historic shock which left 22 million people unemployed? Here BofA offers five explanations:

-

An uneven recession: the shock disproportionally impacted the lower income population who are less likely to be homeowners. Consider that 55% of households earning less than $35K a year lost employment income vs. only 40% of those earning $75K and above. According to the NAR, the median household income of recent homebuyers is $93k.

-

Record low interest rates: mortgage rates reached a new historic low last week. Average monthly mortgage payments have declined by $80/month relative to this time last year due to lower mortgage rates.

-

Running lean pre-crisis: inventory was low, home...