Authored by Lance Roberts via RealInvestmentAdvice.com,

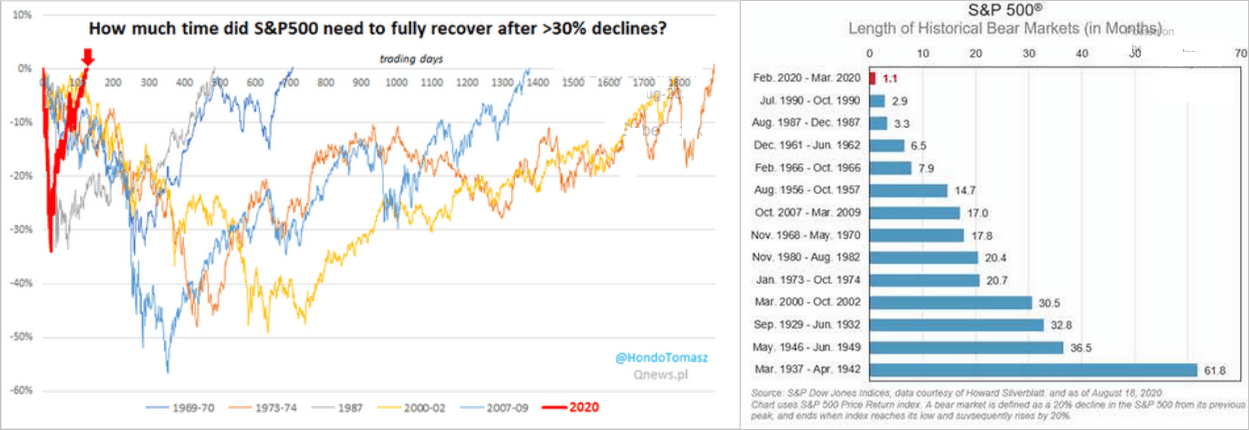

As we have been discussing, this past week, the S&P 500 index set an all-time high. Importantly, the breakout to all-time highs confirms the 35% decline in March was only a correction and not a bear market. The implications are important as the change of definition suggests a bear market still lurks for the full-market cycle to complete.

“The S&P 500 set a new record high this week for the first time since Feb. 19, surging an eye-popping 51% from its March 23 closing low of 2,237 to a closing high of 3,389 on Tuesday. This represents the shortest bear market and third fastest bear-market recovery ever.” – Sam Ro

To understand why March was not a “bear market,” we have to break the analysis into several key components:

-

What defines a bull and bear market?

-

What exactly is a “full-market cycle?”

-

How deep will a “bear market” contract?

Bear Market Definition Is Arbitrary

Let me start with an insightful note from Sentiment Trader:

“The S&P 500 finally did what it’s been trying to do for days now, and crept to a new high.

This ended its shortest bear market in history. Using the completely arbitrary definition of a 20% decline from a multi-year high, it has taken the index only 110 days to cycle to a fresh high. That’s several months faster than the other fastest recoveries in 1967 and 1982.”

Such was a point I discussed on May 20th in “Just A Big Correction:”

...