Authored by Lance Roberts via RealInvestmentAdvice.com,

Bulls Breakout To New Highs

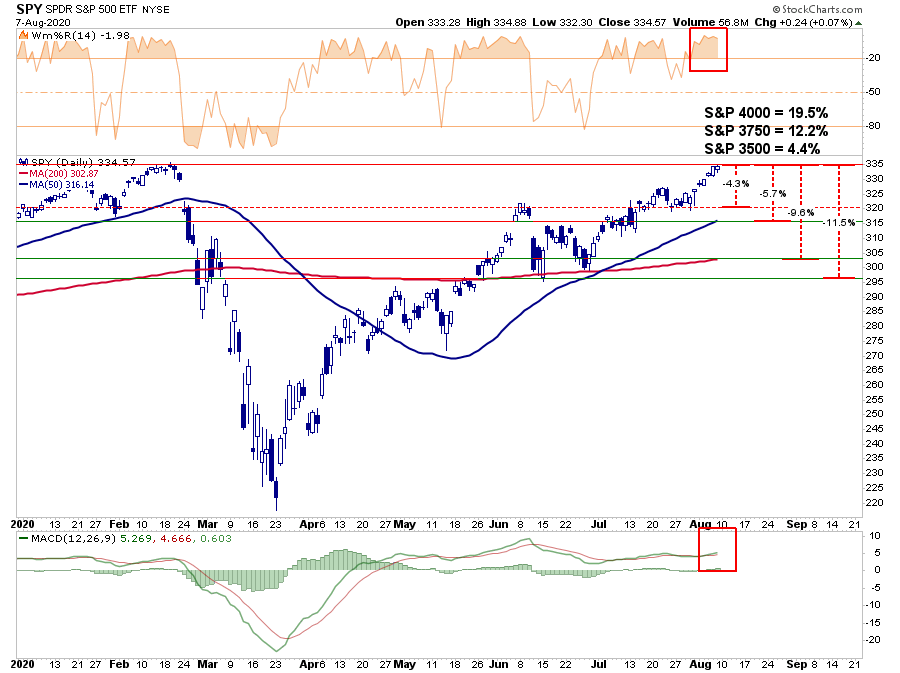

A couple of weeks ago, I wrote a wildly unpopular article laying out why, if the bulls could push the markets to new all-time highs, the next target would be 3750. With the market now at new all-time highs, and the bulls clearly in charge, is it “safe” for investors to become complacent? Maybe, not.

Technical analysis works well when there are defined “knowns” such as a previous top (resistance) or bottom (support) from which to build analysis. However, when markets break out to new highs, it pretty much becomes a “wild @$$ guess” or “WAG.”

However, we did previously attempt to establish some reasonable targets based on relative “risk/reward ranges,”

“With the markets closing just at all-time highs, we can only guess where the next market peak will be. Therefore, to gauge risk and reward ranges, we have set targets at 3500, 3750, and 4000 or 4.4%, 12.2%, and 19.5%, respectively.”

“Given there is no good measure to justify upside potential from a breakout to new highs, you can personally go through a lot of mental exercises. While there is certainly a potential the market could rally 19.9% to 4000, it is also just as reasonable the market could decline 22.2% test the March closing lows.

Just in case you think that can’t happen, just remember no one was expecting a 35% decline in March, either.”

We then delved into establishing a target using the well-established trendlines from the 2009 lows. Given these trendlines have held for over a decade,...