Following more rebounds in 'soft' manufacturing survey data in Europe and Asia (and LatAm - Brazil Manufacturing PMI exploded to a record in July), both ISM and Markit's measures of US manufacturing sentiment were expected to continue their v-shaped recovery, and they did just that, when first the Markit PMI printed at 53.1, the highest level since January 2019, followed by the ISM Manufacturing, which smashed expectations, printing at 56.0, the highest since November 2018.

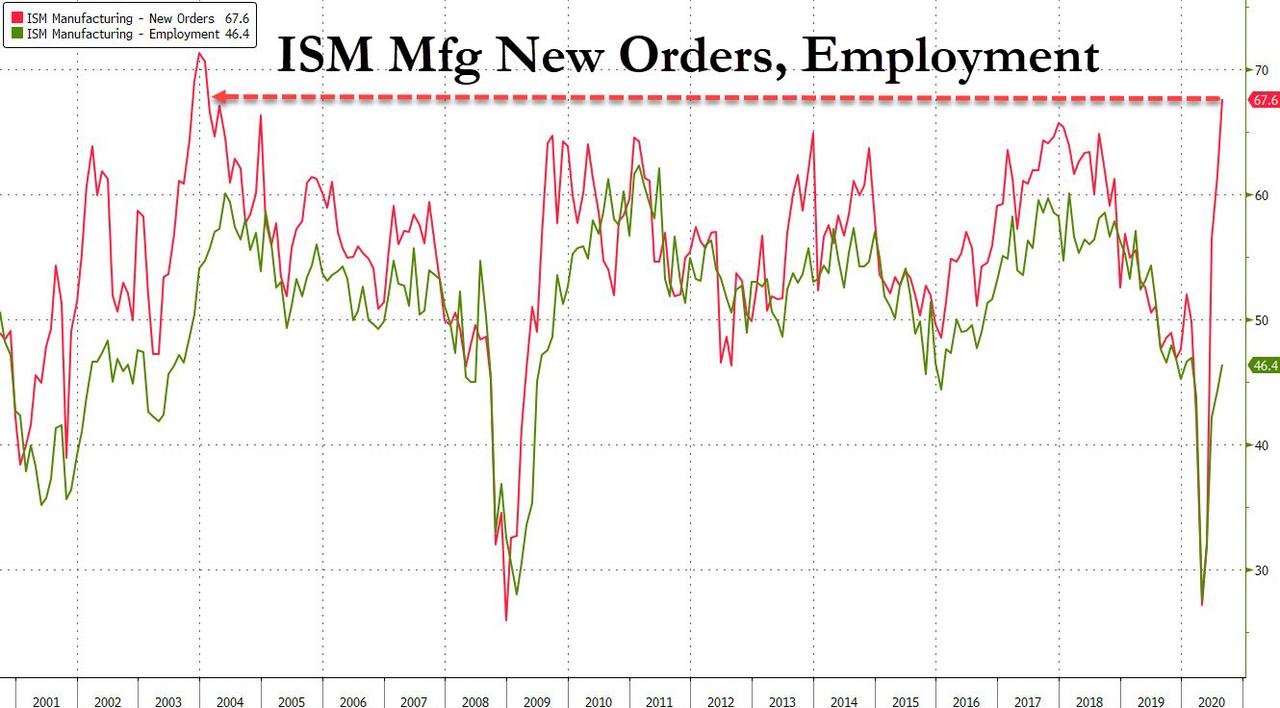

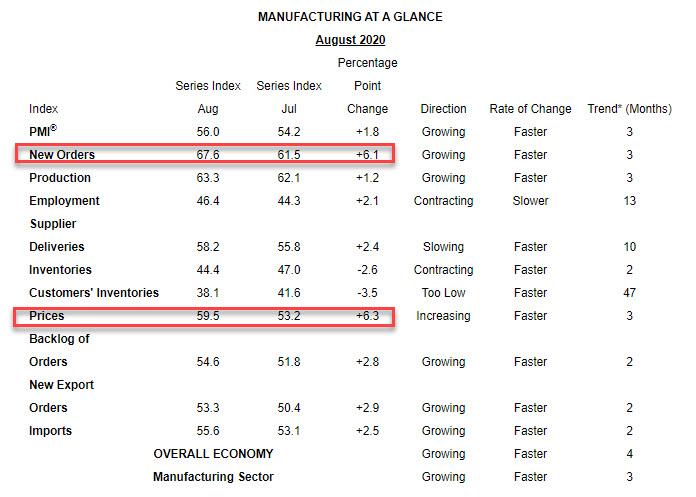

Just like last month, the ISM surge was driven largely by New Orders which spiked from 61.5 to 67.6, the highest level since Jan 2004, and while employment continued to rise, from 44.3 to 46.4, it remains in contraction territory.

Looking across the data, virtually all ISM components improved with the exception of Inventories which dipped for both producers and customers, a sign that destocking is taking place and which is actually bullish for even more future demand.

Meanwhile, unlike last month, when the Markit PMI unexpectedly missed, this time there was convergence between the two series, with Markit noting that the strongest Mfg PMI since Jan 2019 "was underpinned by stronger new order growth as exports rose at the quickest pace for four years."

On ISM, Chair Timothy Fiore said that "The August PMI registered 56 percent, up 1.8 percentage points from the July reading of 54.2 percent. This figure indicates expansion in the overall economy for the fourth month in a row after a contraction in April, which ended a period of 131 consecutive months of growth. The New Orders Index registered 67.6 percent, an increase of 6.1...