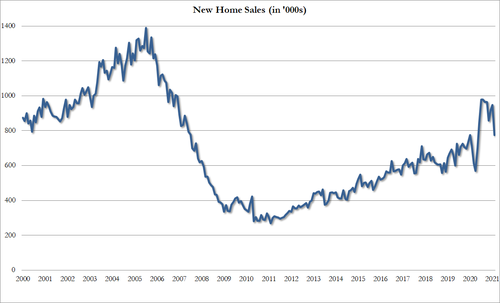

Following the unexpected tumble in existing home sales, new home sales have crashed in February. Against expectations of a 5.7% MoM drop, sales collapsed 18.2% - worse than at the peak of the crisis last year and the worst MoM drop since 2013

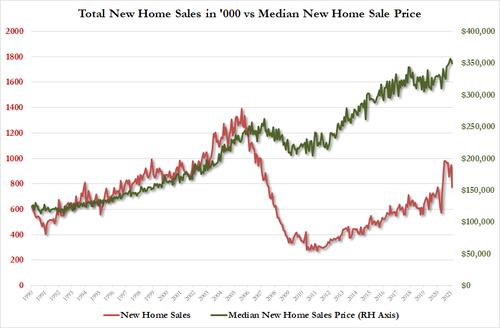

Sales dropped in all regions across the U.S.. Notably, extreme weather had an impact with MidWest sales plunging 37.5% and Texas sales collapsing...

Housing demand is being restrained partly by a limited number of available properties that offer interested buyers fewer choices at the same time prices remain elevated.

But, as Wolf Richter details in his latest report at WolfStreet.com, we suspect that these are the first signs that higher mortgage rates are impacting the housing market.

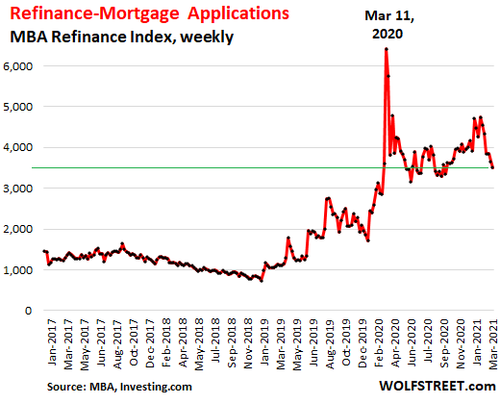

Mortgage refis have dropped since January, driven by a sharp drop in no-cash-out refis; cash-out refis have also dropped, but less so, for a reason we’ll get to in a moment. This chart shows the Mortgage Bankers Association’s mortgage refi index:

No-cash out refis “are already seeing large volume declines,” according to a report by the AEI Housing Center, which pointed out that due to the higher rates, fewer loans are “in the money.”

Cash-out refis are also down but only modestly, “as these borrowers are driven more by cash needs than rates,” the AEI report said.

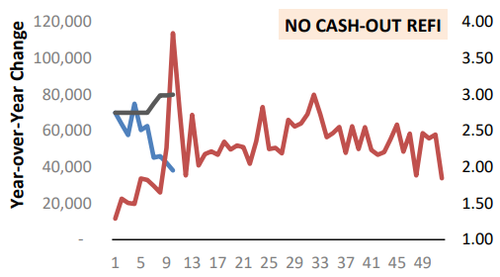

The chart by the AEI Housing Center shows the weekly no-cash-out refis in 2021 (light-blue line, left scale) heading south, and in 2020 (brown line); it also shows the median mortgage rate in 2021 (dark blue line). The time line indicates the weeks of the year:

The AEI’s weekly...