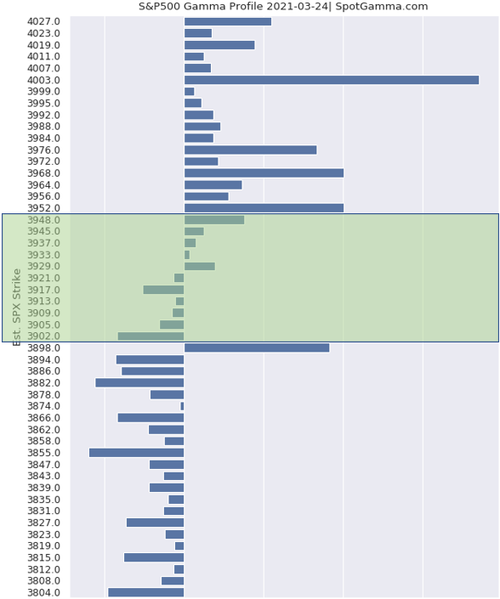

A volatile overnight session in the S&P 500 has left in the middle of a range between 3900 and 3950.

If you look at SpotGamma's total S&P500 profile you can see the “box” the market is in, and whats curious is that this picture has remained the same for the past several sessions. In other words, its not “filling in”.

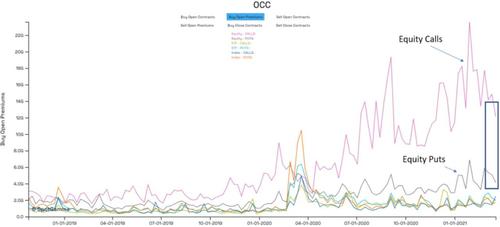

As SpotGamma notes, "there is a sense of decay or attrition happening on the call side."

Call-option buy-to-open premiums are sliding (less demand)...

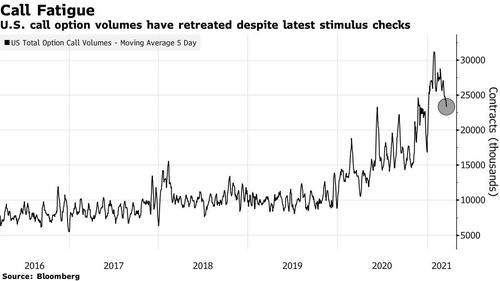

And call volumes are down hard... A daily average of 23 million contracts has changed hands on U.S. exchanges over the past five days -- down from more than 30 million in February.

Source: Bloomberg

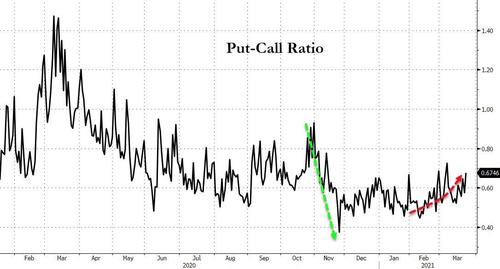

And the put-call ratio is on the rise again...

Source: Bloomberg

Elevated call volumes “stood out to us as being the best indicator of the public’s intensity of affection for the equity markets,” said BTIG chief equity and derivatives strategist Julian Emanuel.

“It’s not quite as elevated as it was in January, because frankly I think there’s a portion of the public that is sitting on losses in these meme stocks since that time.”

SpotGamma warns that while a few data points certainly do not make a trend, but if you are of the belief that rampant call buying was a key catalyst for markets then this is some cause for concern. We stress that this doesn’t imply the market crashes, but it does suggest less upside fuel.

Finally, we know the reason why call-buying is fizzling...