A funny thing happened on the way to a hyped-inflationary future...

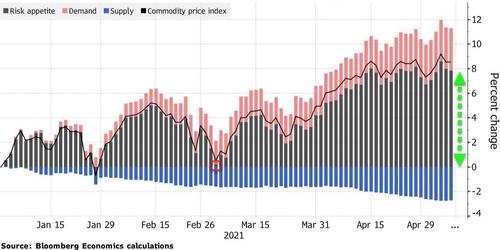

In the great inflation debate (transitory or not), the rally in everything from copper to soybeans to lumber has been a point in favor of the reflation hawks. But, as Bloombergs Tom Orlik notes, movements in commodity prices this year have been mainly driven by risk appetite, not fundamental demand or shortages of supply.

In other words, a majority of the realized 'inflation' in commodity prices is really driven by speculation on that inflation.

As SocGen's Albert Edwards recently pointed out (echoing Bloomberg's John Authers' recent note), there is a "reflexivity" to investors' belief in rising inflation.

For when they pile into commodities as an investment vehicle to benefit from rising inflation, they create substantial upstream cost pressures – as has been highlighted by PMI corporate surveys. Beyond the cascading effect of upstream commodity price pressures, headline CPIs are also quickly impacted as food and energy prices rip higher.

In addition to this, the observation by investors that industrial commodity prices are rising only serves to reaffirm their belief about cyclical strength and rising inflation - most especially “Dr Copper”, which many investors see as extremely sensitive to economic conditions.

The circular, or as George Soros terms it, ‘reflexive’ nature of financial markets makes them extremely vulnerable to being whipsawed. Yet because of the current extreme momentum it would take a very heavy weight of evidence to convince this market to reverse direction.

However, as the recent rapid decline of numerous industrial metals (and lumber) from their peak suggests, a rise in commodity prices driven primarily by speculation is also prone to a...