With 'hard' data serially disappointing over-exuberant expectations for the last few months, 'soft' surveys continue to offer 'hope' (albeit mixed) for recovery-hyping equity bulls that the vast gap between the market and economic reality will somehow be filled. After ISM's surprise tumble last month (and PMI's ongoing rise in flash data), the final data for May was expected to show marginal improvements for both manufacturing surveys.

-

Markit US Manufacturing PMI beat expectations, rising from 60.5 for April and from 61.5 flash for May to a final 62.1 for May - a record high.

-

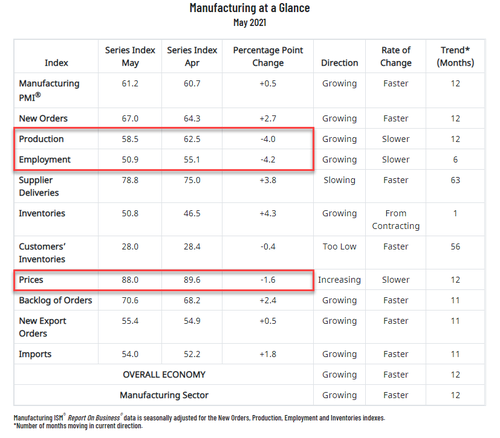

ISM Manufacturing beat expectations, rising from 60.7 in April and expectations of 61.0 for May to 61.2.

Source: Bloomberg

Markit notes that the degree of optimism remained upbeat on average, but dipped to a seven-month low amid concerns regarding future supply flows.

And that lack of optimism is clear in the ISM employment data which tumbled...

Source: Bloomberg

Survey respondents:

-

“The continued global supply chain tightness and raw material shortages from the Gulf (winter storms) make it less likely that any business can recover this year. Demand is strong, but what good is that if you cannot get the materials needed to produce your finished goods?” [Nonmetallic Mineral Products]

-

“Supplier performance — deliveries, quality, it’s all suffering. Demand is high, and we are struggling to find employees to help us keep up.” [Computer & Electronic Products]

-

“Changes in currency exchange rates favorably contributed to our quarterly performance.

-

Continued strong consumer demand for our...